Donate to your favorite cause.

Make a crypto, stock or DAF donation to nonprofits, charities, universities, faith-based, and other mission-driven organizations.

First time donating? See how easy it is.

Other ways to give

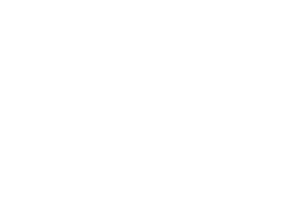

Create a Fundraiser

Champion for a cause and raise money on behalf of an organization that’s close to your heart.

Save on your taxes by donating non-cash assets.

There’s a reason high net worth individuals tend to donate property instead of cash. Donating cryptocurrency or stocks directly to a 501c3 nonprofit is more tax efficient and can save you money.

Need help with your donation?

We’re here to assist! Our dedicated donor support team is ready to provide the help you need.