There are many ways to support your favorite charities—by volunteering, donating cash, and donating cryptocurrency as just a few examples. Did you know that you can also donate stocks?

Donating your stocks directly to nonprofit organizations makes a bigger impact compared to donating cash or selling stocks first and then contributing the proceeds. By making a direct stock donation, you can not only increase your tax deduction but also maximize the impact of your gift.

Check out the three main reasons why you should consider donating stock to charity, and find out how you can donate stocks in several easy steps through The Giving Block.

Three Main Benefits of Stock Donations

It’s A Highly Efficient Process

Donating stocks can seem like a daunting task. Luckily, The Giving Block takes the work out of the process. It’s simple for donors to select a stock donation option through our Donation Form, and The Giving Block helps process the transaction.

All you have to do is find your favorite nonprofit on The Giving Block’s donation platform. Check out our instructions below to see just how easy and efficient it is to donate stocks to the charities you know and love.

You’re Able to Give More

After you invest in stock, hold onto it for at least a year before you donate it; that qualifies it as a long-term investment. By donating stock that has appreciated for more than a year, you are able to give more due to long-term capital gains than if you sold the stock and then made a donation using the cash proceeds.

That’s because you pay capital gains taxes once you’ve sold an investment. By donating your stocks directly to charities, you’re able to donate the entire amount of your stock’s present-day market value.

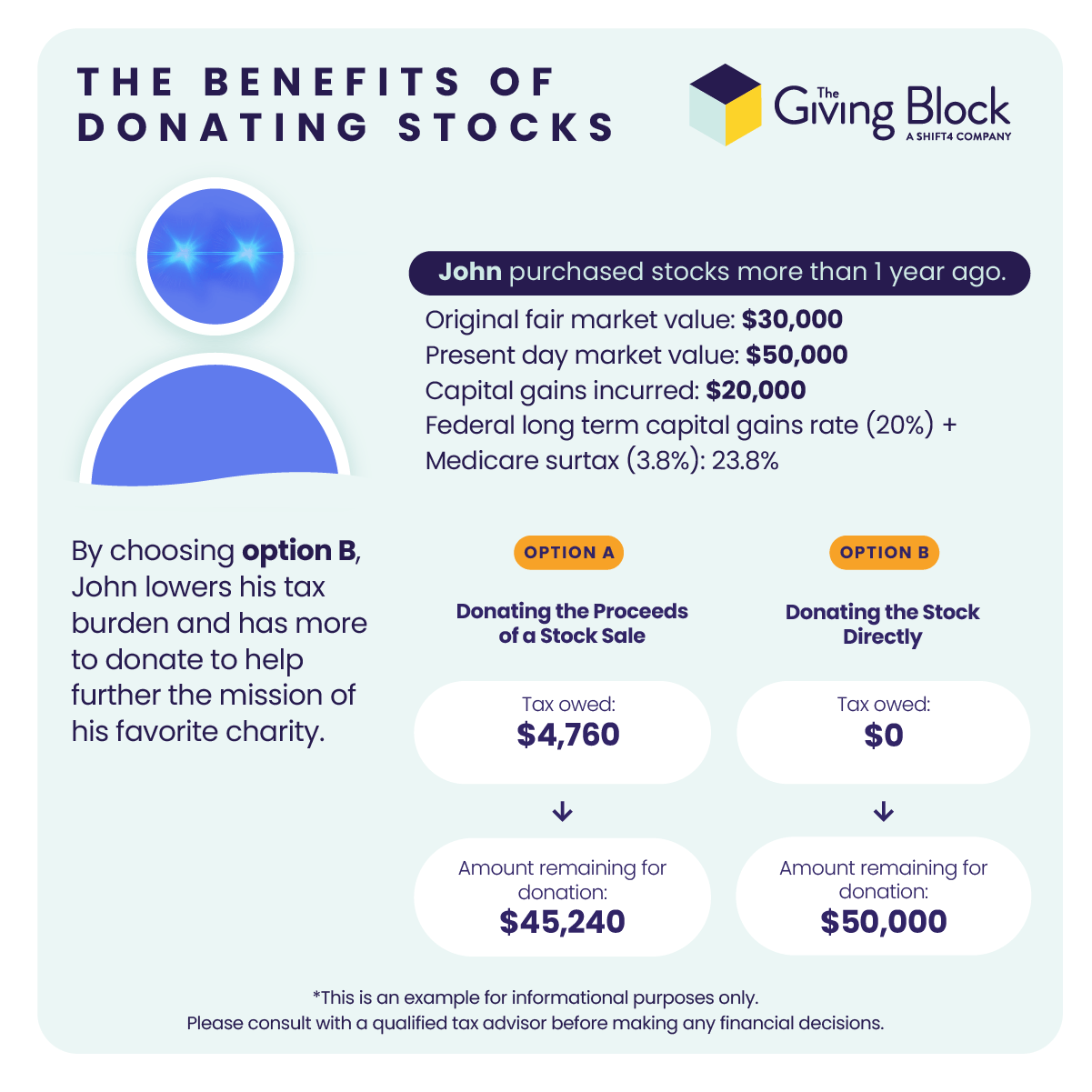

Say someone purchased stocks more than one year ago.

- The original fair market value of those stocks was $30,000.

- The present day market value is $50,000.

- Capital gains incurred is $20,000 with a federal long term capital gains tax rate at 20% and Medicare surtax at 3.8%.

If they decide to sell their stock first and donate the proceeds, they’ll owe $4,760 in taxes, leaving $45,240 to donate. However, if they donate the stock directly to a nonprofit, they’re able to donate the entire present day market value of $50,000.

By choosing to donate stock directly, a donor is able to lower their tax burden and they have more to donate to help further the mission of their favorite charity.

An Opportunity for a Portfolio Review

Donating stocks is also a great opportunity to take some time to assess your investment portfolio, especially in the context of charitable giving.

It’s important to continually review your portfolio and reset the cost basis on certain holdings. Keep track of the performance of your investments and how much in taxes you may have to pay if you sell, versus ways to reduce your tax burden. Consider long-term, recurring gifts to charity and assess how these charitable gifts may influence your portfolio.

The Impact of Your Stock Donations

Donating stocks is easy, but exactly what kind of difference does it make? Your stock donation helps nonprofits all around the world reach their fundraising goals and further their missions, impacting hundreds of lives and communities. For example:

- Every $1 raised helps the Chattanooga Area Food Bank provide three meals to those in need. Consider how many meals a single stock donation could provide to the Chattanooga community.

- Every donation helps Mental Health America provide hundreds of essential mental health screenings to those who are struggling.

- Donations to foster care nonprofits don’t just provide children a safe place to sleep at night but also help empower youth and their families to have long, healthy lives.

Through The Giving Block, you can use your investments to support thousands of nonprofits in dozens of different cause areas, from female empowerment to civil and human rights.

How to Donate Stock to Charity Using The Giving Block

The Giving Block makes it easy to donate stock to your favorite nonprofits. All you have to do is follow these steps:

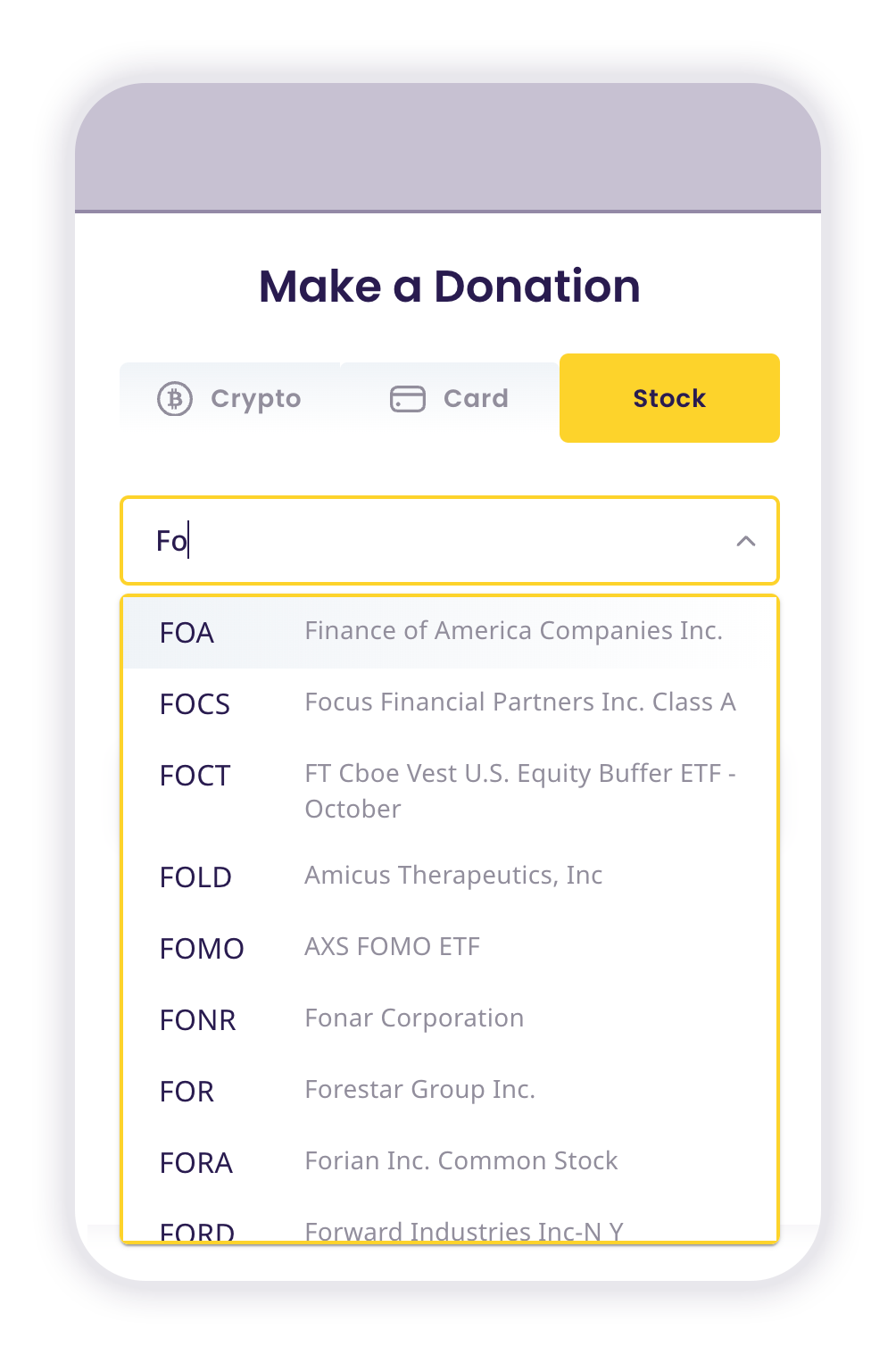

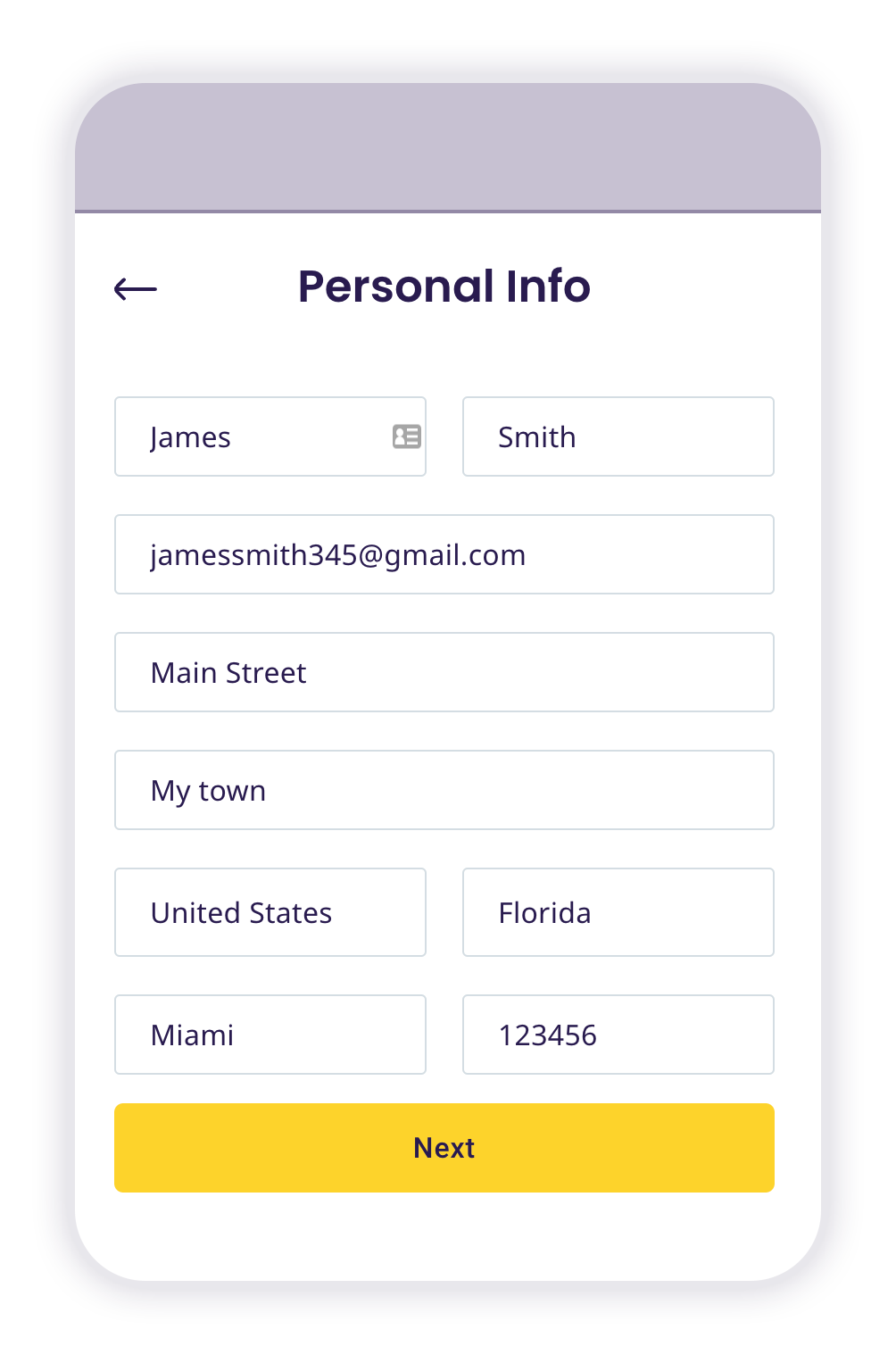

1. Go to The Giving Block’s donation Donation Form or the website of the charity of your choice. In the Donation Form, click on “Stock.” Then select the ticker symbol for the stock you’d like to donate.

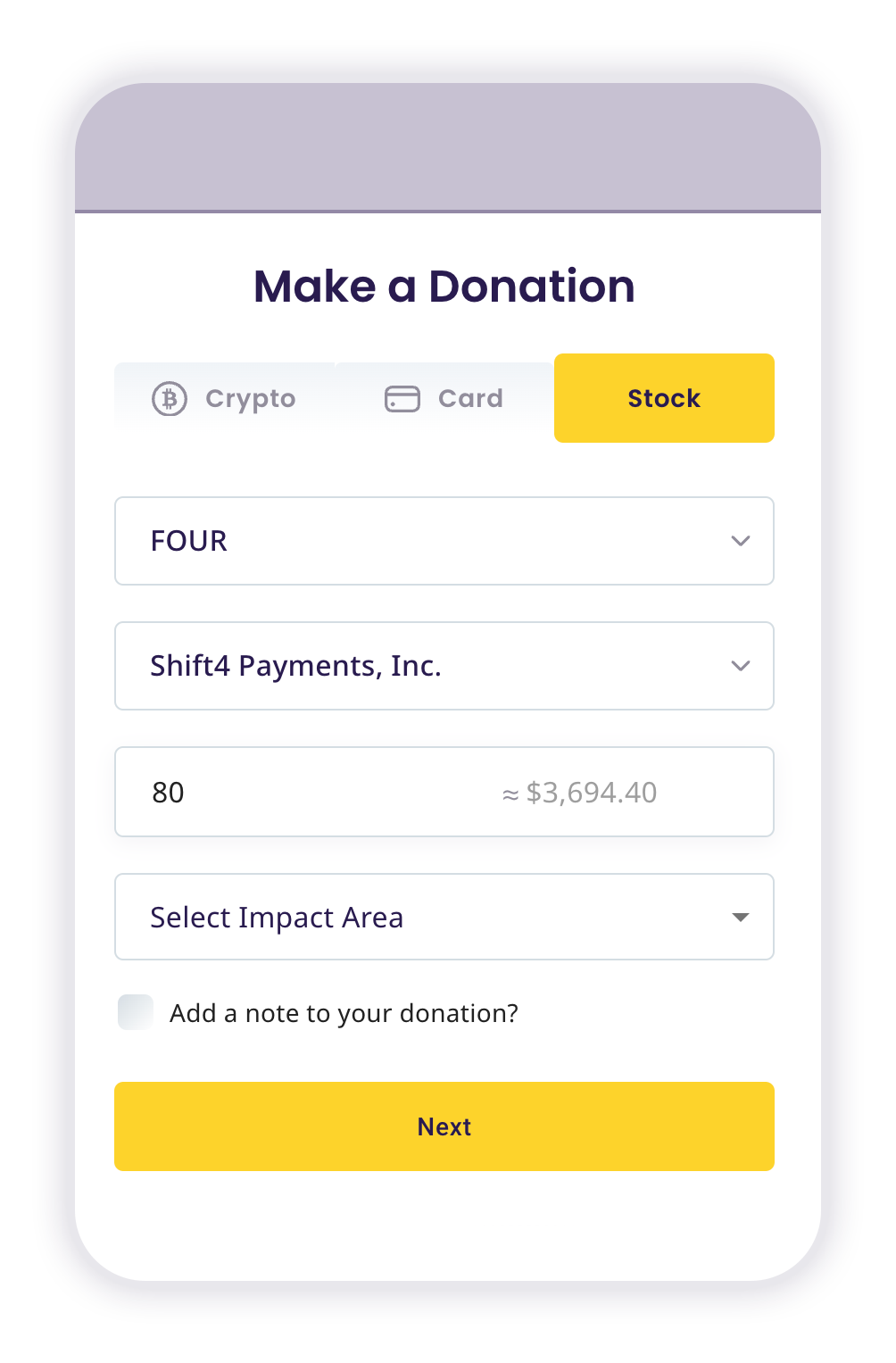

2. Input the quantity of shares and The Giving Block will generate approximately how much you’re donating in USD.

3. Fill in your name, email, and address.

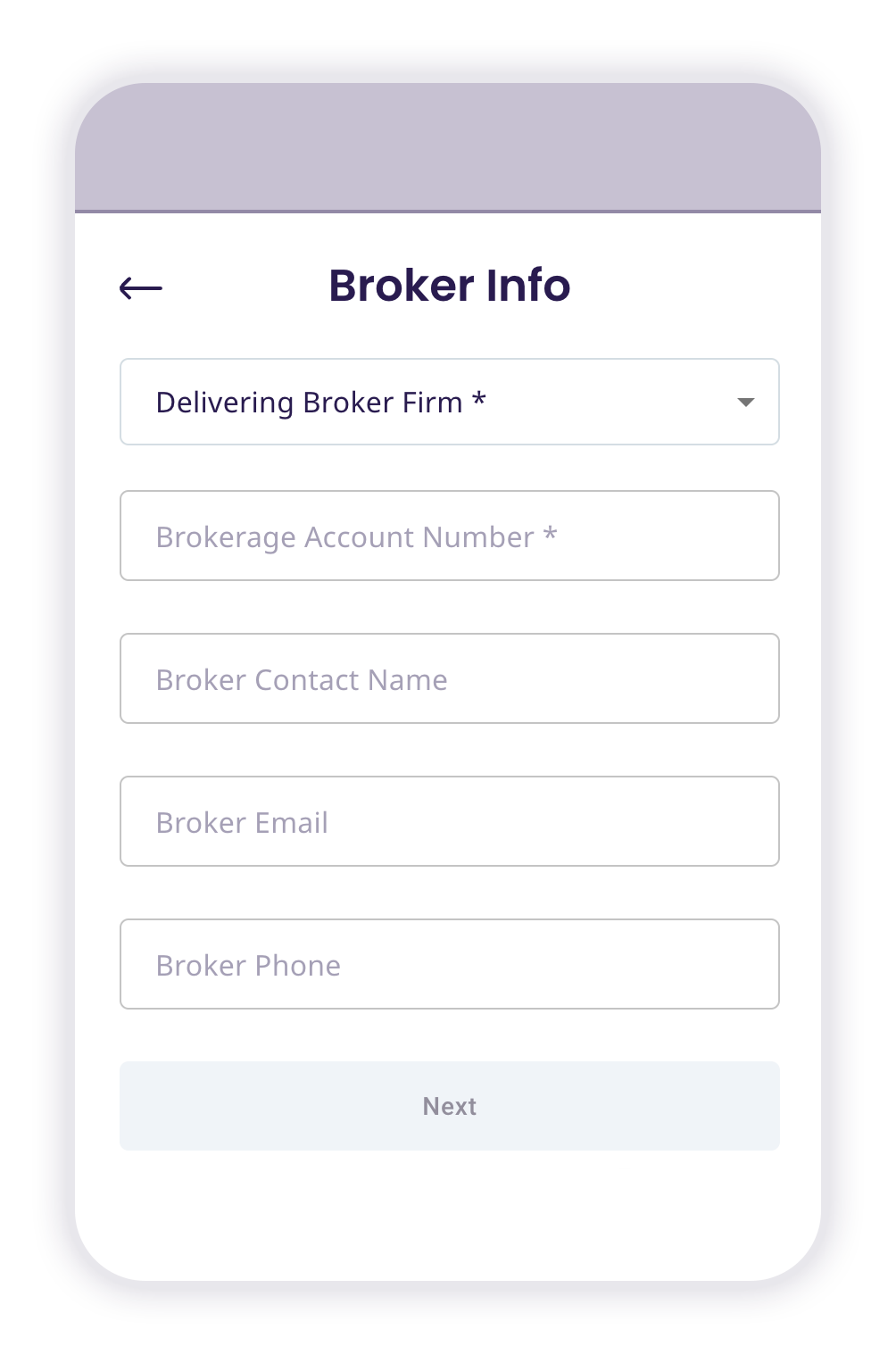

4. Put in your broker’s information. If your broker is not yet supported by The Giving Block, select “other” and you’ll receive further instructions by email.

5. Your donation is complete and you’ll receive a tax receipt by email once your donation is processed.

Donate Stock to Charity Today

If you have appreciated securities, donate them to your favorite nonprofits through The Giving Block. By donating stock directly, you can maximize your tax deduction and create a big impact on the causes that you’re passionate about. Just follow the steps outlined above, and get started on making a difference today.