The question of whether or not church donations are tax deductible affects millions of Americans every year. After all, the single-biggest cause for US donors is religion, with 27% of charitable gifts going towards houses of worship or faith-based organizations in 2022.

The short answer is that yes, donations to a church are generally tax deductible, as are charitable gifts made to mosques, synagogues and other houses of worship that are registered as 501(c)(3) charitable organizations.

But there are a few important variables that determine how you can qualify for these tax deductions and how much you can write off as a charitable deduction.

In this article we explore these factors and break down what you need to know about donating to a church or house of worship.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.

So, Are Church Donations Tax Deductible? Yes.

The good news is that your church donation can qualify for a tax deduction. Typically, you can get this deduction from your tithing as long as it meets this criteria:

1. Your church (or other house of worship) is registered as a charity

In the US, churches need to be registered as 501(c)(3) charitable organizations in order for their donors to qualify for tax deductions.

If you’re not sure, your church likely displays its 501(c)(3) status on its website. Check the website’s footer, its “about” page or its main donation page.

You can also use the IRS’ online Tax Exempt Organization Search Tool to be 100% sure.

What the Bible says is really true—it’s better to give than to receive.

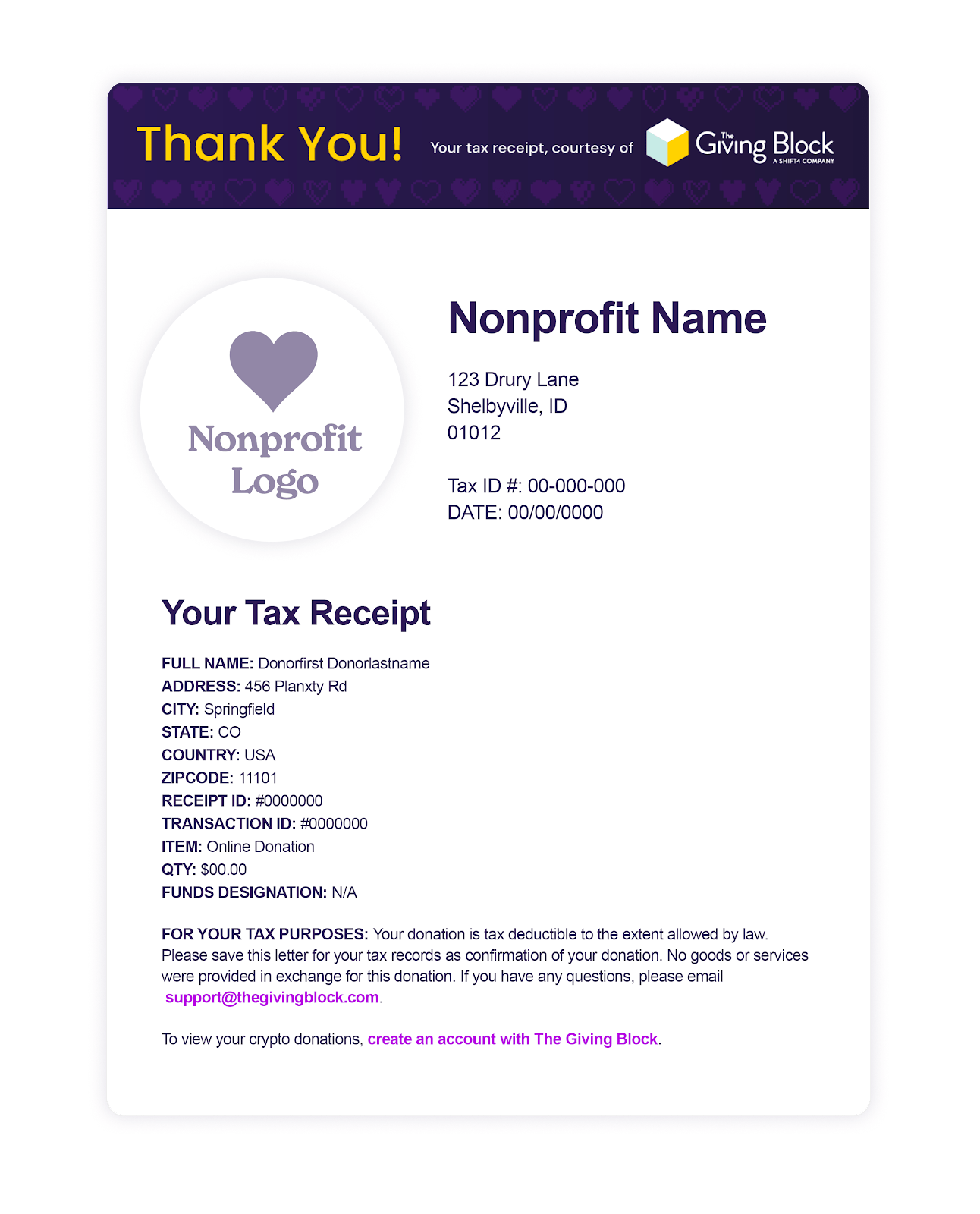

2. You kept donation receipts for your church donations

Many taxpayers just take the standard deduction when they file their taxes.

But if you choose to take the charitable contribution deduction instead, you’ll need to itemize all of your qualified deductions. If so, be sure to have all of your donation receipts saved.

Depending on how you give, these receipts might be hard-copy letters you received in the mail or emails. (If you don’t see one in your inbox, check your spam folder.)

This receipt is a formal acknowledgment that should include the name of your church, its Tax ID Number, the amount you gave, and the date of your donation.

If you donate online, be sure to opt into receiving a tax acknowledgment letter if the option is presented to you.

3. You donated an asset that can qualify as a charitable contribution

Tithing is typically thought of as some form of cash, check, or credit card donation.

But there are many forms of giving that charitable organizations accept and actively steward from supporters.

Volunteering and Goods: You might be wondering if the IRS would consider volunteer hours or food donations as a qualified charitable contribution. According to the IRS, goods like clothing and household items may count, while volunteer hours do not.

Donor-Advised Funds: You might want to recommend a grant from your Donor-Advised Fund, which is an increasingly popular way to donate. If so, keep in mind that assets in your DAF were eligible for tax deductions for the tax year when you deposited them, not when you grant them to a church or charity.

Crypto and Stock: And then there’s the case of non-cash assets like cryptocurrency and stock shares. These giving methods definitely can qualify, and they can also offer greater tax benefits than donating cash. Learn more about the tax benefits of crypto and stock giving.

For a complete list of what you can and cannot write off, you can look at IRS Publication 526 (2022), Charitable Contributions.

Your church may already accept crypto, stock and DAF donations via The Giving Block. Search for your church in our donation marketplace.

Embrace Crypto Fundraising like VIVE Church

Soon after VIVE Church started accepting cryptocurrency donations, crypto donors supported them with $300,000 worth of crypto assets, helping the church purchase a new building and increase their community reach.

More Resources for Church Donors

Of course, filing your taxes on time is the other “must” for qualifying for tax deductions on your church donations. And that means knowing where to give, what to give, and how much to give.

If you regularly attend a church or house of worship, you may have already solved the “where” question.

But today, more churches and charitable organizations are actively seeking crypto or stock donations. So before you take out your checkbook or credit card, consider whether there’s another way to give that allows you to give more and save more when it comes time to file your taxes.

- Find a church or charity to support with a donation.

- Estimate your crypto or stock donation tax benefits.

- Explore our tax resources and a list of tax advisors.

No matter how you give, or how much you give, you should feel glad that your tithing or other form of charitable giving will make a difference for the greater good.

About The Giving Block

The Giving Block, a Shift4 company, is the platform helping nonprofits fundraise more effectively from modern philanthropists. As pioneers of the “Crypto Philanthropy” movement, The Giving Block developed the leading solutions for cryptocurrency donations, taking crypto and NFT donations mainstream in the nonprofit sector. The Giving Block’s team then developed a stock giving experience built to empower even more donors to give non-cash assets. When combined, The Giving Block’s product suite empowers more donors than ever to give assets to their favorite causes. Today, thousands of nonprofits are using The Giving Block to fundraise from modern philanthropists.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.