The crypto market is HOT, led by the rising prices of Bitcoin, Solana, and many other cryptocurrencies. But if you plan to sell your crypto for a profit at any point, you’ll owe capital gains that can often exceed 20 or even 30 percent, depending on your income, gains, and the state where you reside.

Crypto users that pay taxes in the US have a powerful tool to lower their overall tax burden, and that’s by making charitable crypto donations.

In this short guide, we will shine a light on how donating crypto to registered 501(c)3 nonprofits is a smart move for financially-savvy investors and contributes positively to society.

Note: The Giving Block is not a tax advisor and does not give financial advice. This article is for informational purposes only. Please consult a tax advisor regarding your financial situation.

Contents

- TL;DR: Donate Crypto, Lower Taxes

- How Cryptocurrency Gains Are Taxed

- Current Crypto Tax Rates

- Determining Your Cryptocurrency Taxes

- Reporting Your Crypto Holdings

- Minimizing Your Crypto Tax Burden

- The Tax Benefits of Donating Crypto

- Elevating Your Financial Strategy through Strategic Crypto Donations

TL;DR: Donate Crypto, Lower Taxes

Cryptocurrency donations can dramatically lower your tax burden—and here’s why:

Due to its tax treatment by the IRS, by donating appreciated crypto, you won’t owe capital gains tax on those appreciated assets as you would have if you had sold the crypto first.

For that reason, donating crypto is also more tax-efficient than donating cash.

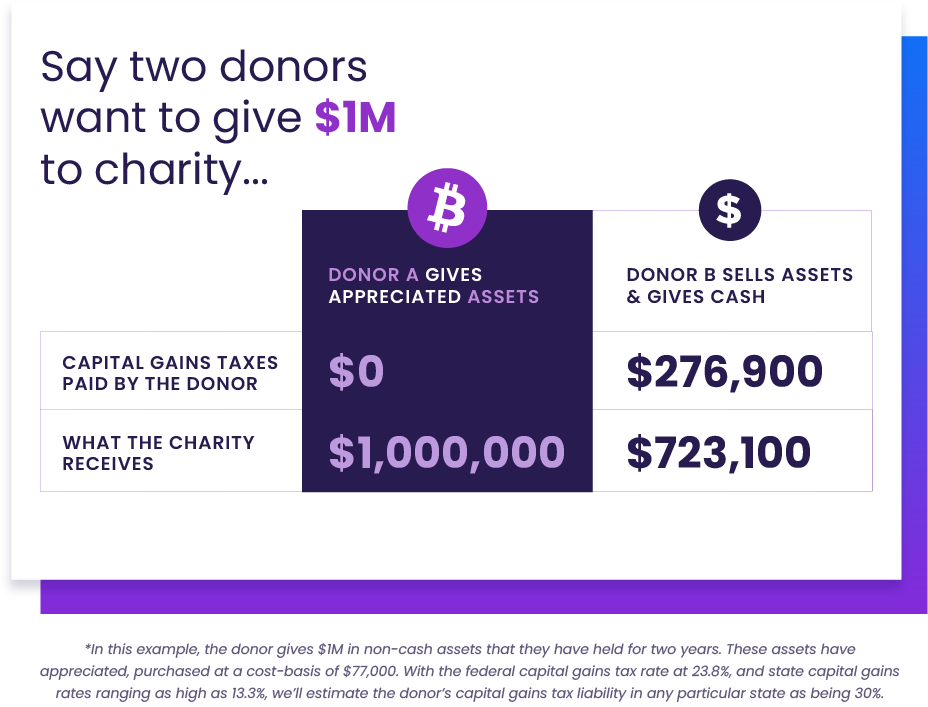

The difference between (A) selling your crypto then donating the after-tax remainder vs. (B) donating crypto directly can be substantial. The latter can help you avoid those capital gains taxes (often 20% or higher).

In the end, donating crypto lowers your taxes and empowers you to give more to the cause of your choice.

>> What do Vitalik Buterin, Gary Vee, and Yam Karkai have in common? They’re all honorees of our Faces of Crypto Philanthropy series.

How Cryptocurrency Gains Are Taxed

Despite the surging popularity of Bitcoin and its counterparts, tax codes don’t categorize them as regular currency equivalents. Each crypto transaction, whether it involves a sale or exchange, triggers distinct tax considerations.

According to IRS guidelines, “virtual currencies” (aka cryptocurrencies) fall under the property category for federal tax purposes. Essentially, the principles governing property transactions are applicable to cryptocurrencies.

Current Crypto Tax Rates for 2025 & 2026

For tax purposes, cryptocurrency and other digital assets are treated as property by the IRS. Whenever you sell, trade, or spend crypto, the transaction is subject to capital gains or losses, based on the difference between your cost basis and the sale or exchange value.

A capital gain occurs when you sell a crypto asset for more than you paid for it, while a capital loss happens when you sell for less. The tax rate depends on how long you held the asset and your total taxable income.

Short-term gains—for assets held one year or less—are taxed as ordinary income at the same rates as your regular earnings. In 2026, these federal rates range from 10% to 37%, depending on your income bracket. Long-term gains—for assets held more than one year—are taxed at preferential rates of 0%, 15%, or 20%, also based on income thresholds.

In addition, high-income taxpayers may owe the 3.8% Net Investment Income Tax (NIIT). This tax applies to the smaller of your net investment income or the amount by which your modified adjusted gross income (MAGI) exceeds $200,000 (single), $250,000 (married filing jointly), or $125,000 (married filing separately). When applicable, the effective top federal rate on long-term capital gains is 23.8%.

Finally, remember that state taxes can further increase your total tax liability. Most states tax capital gains as ordinary income, with rates that can push combined federal and state taxes for top earners into the 30%+ range. However, some states (like Florida, Texas, and Wyoming) impose no state income tax.

2025 Long-Term Capital Gains Tax Rates (for filing in 2026)

| Tax-filing status | 0% tax rate | 15% tax rate | 20% tax rate |

| Single | $0 to $48,350. | $48,351 – $533,400. | $533,400 or more. |

| Married, filing jointly | $0 to $96,700. | $96,701 – $600,050. | $600,050 or more. |

| Married, filing separately | $0 to $48,350. | $48,351 – $300,000. | $300,000 or more. |

| Head of household | $0 to $64,750. | $64,751 – $523,050. | $566,700 or more. |

Determining Your Cryptocurrency Taxes

If your crypto investments have resulted in gains, you can be pretty certain that it will impact your taxes. Given the unique nature of each individual’s circumstances, consulting with a tax advisor is a smart step.

And if you’ve done more than simply purchasing and selling crypto (e.g., engaging in crypto-to-crypto transactions, receiving airdrops), these transactions will also have implications for your tax reporting.

- Crypto Mining: Earnings from crypto mining or the sale of mined crypto are subject to capital gains taxes. Hobbyist miners should report mined crypto as “Other Income,” while professionals utilize Schedule C for their earnings.

- Gifts and Inheritance: Receiving crypto as a gift incurs no immediate tax obligation. However, taxes come into play upon selling or trading the gifted crypto. Inherited crypto is valued as of the testator’s date of death.

- Forks, Airdrops, and Splits: Events like hard forks and airdrops may result in taxable income. Proper reporting is essential to account for these additional assets.

- Crypto as Earned Income: Employees receiving cryptocurrency as wages should treat it as ordinary taxable income. Keeping a record of the fair market value on the payment date is essential for tax purposes.

- Crypto Purchases: Using crypto for transactions triggers capital gains taxes. The gain or loss is determined by calculating the difference between what you paid and the original value of the crypto.

>> Seeking Crypto Tax Advice or Assistance? Check out our Tax Resources for Crypto Investors.

Reporting Your Crypto Holdings

Simplify the tax filing process with these steps:

- Record Transactions: Maintain a detailed record, including dates, transaction summaries, and fair market values.

- Complete Tax Forms: Meet deadlines by filing forms like IRS Form 8949, Form 1040 Schedule 1, Schedule C, and Schedule D.

- Use Crypto Tax Software: Crypto tax calculators save time and guesswork by importing your crypto transactions into software that calculates gains and income from crypto. (Tools like Koinly even allow you to tag crypto donations, so you can easily identify the amounts to declare as tax deductions.)

- Consider Professional Assistance: If tax terminology feels overwhelming, seek guidance from a qualified tax advisor who stays abreast of the latest IRS rules.

Minimizing Your Crypto Tax Burden

While each person’s financial situation is different, these tactics have been found helpful in reducing the tax burden of many crypto users:

- Hold for the Long Term: Instead of seeking quick gains, consider holding onto your assets for at least a year to benefit from lower long-term capital gains rates.

- Invest through Retirement Plans: Investigate crypto-backed retirement portfolios, offering tax advantages comparable to traditional IRAs.

- Donate to Charity: Contributing crypto to nonprofits not only supports worthwhile causes but also reduces your tax liability. These donations are not only tax-deductible but also exempt from capital gains tax.

In crypto we get so many opportunities to succeed, sometimes overnight! It only seems right to spread those opportunities to causes that matter.

How Do You Enjoy The Tax Benefits of Donating Crypto?

Imagine this scenario: you purchased Bitcoin, Ethereum or Solana during the low of a bear market, and now it’s gained 100% or more in value. If you’re ready to sell it and enjoy your gains, you’re bound to owe those capital gains taxes.

Follow a few easy steps to make a cryptocurrency donation to a registered 501(c)3 charitable organization:

Whether you are estimating your gains and losses toward the end of the year, or just want to make a tax-efficient donation during the year, consider using your crypto to make a world of difference.

Estimate Your Potential Savings: Interested in estimating your potential tax savings? Try our Crypto Donation Tax Savings Calculator Tool for a personalized assessment.

Reduce Your Tax Burden With A Crypto Donation

By directing your crypto donations toward causes that resonate with you, you’re not just impacting the world positively, you’re also unlocking a door that can ease your tax burden substantially.

Whether you’re racing to meet the 12/31 tax deadline for charitable contributions or just want to use your crypto to make a difference, The Giving Block can help.

Search and filter through thousands of charitable organizations and find a cause that matters to you on our donor marketplace.