Crypto philanthropy is helping to modernize nonprofit fundraising. Among other benefits, crypto donations help organizations diversify revenue, unlock major gifts, and reach a new donor demographic.

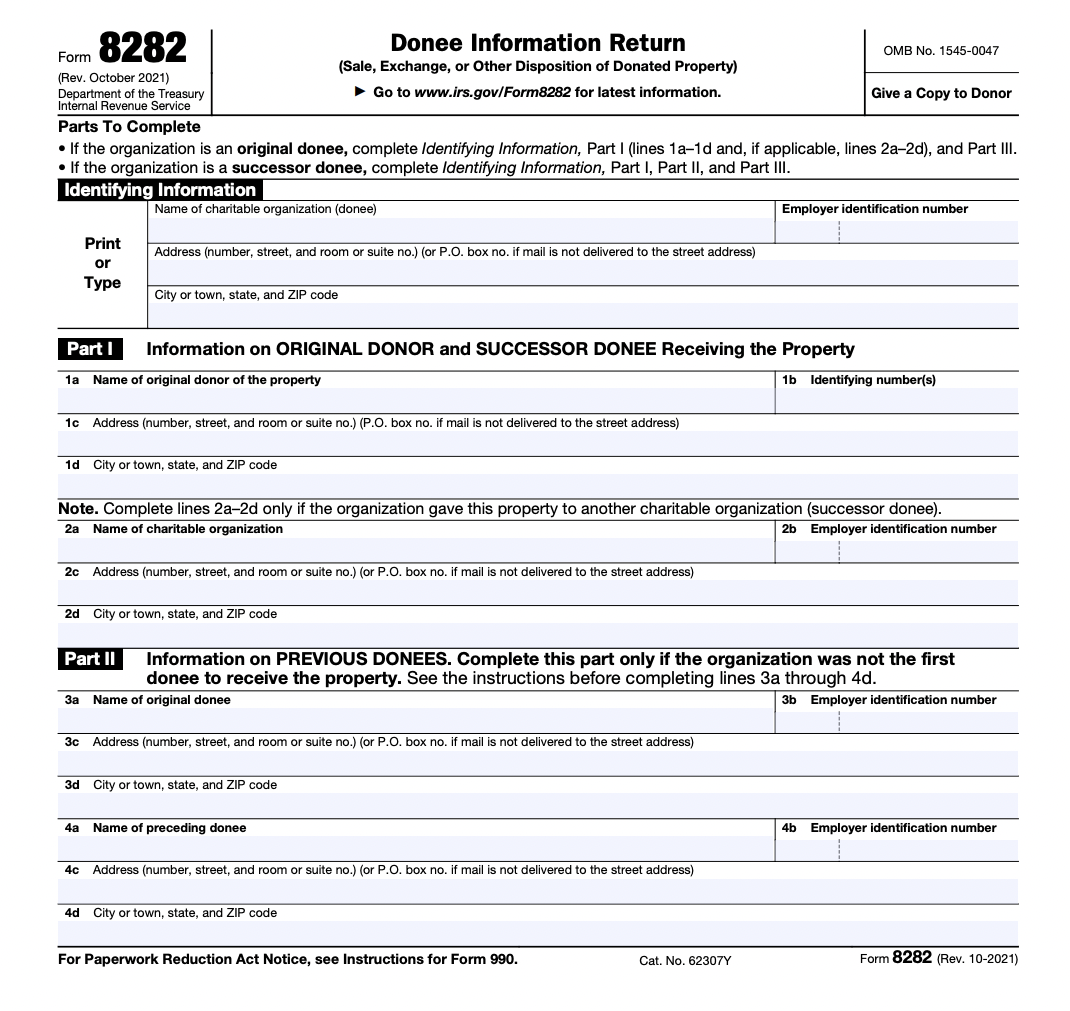

So what happens after your nonprofit receives a crypto donation? Typically, you’ll sell it for its fair market value in cash, then report this “disposal” of the donation to the IRS using Form 8282.

Ready to tap into crypto fundraising, but not sure about those extra forms? You’re in luck! By getting started with The Giving Block’s crypto fundraising solution, you can automate Form 8282 generation for crypto donations.

Want to know more about IRS Form 8282? Read on for the details. Plus, learn how The Giving Block can help your nonprofit spend more time fundraising (and less time reporting).

In Brief

- Charitable organizations complete Form 8282 after disposing of a non-cash donation.

- Some exceptions apply, such as for donations under a certain value.

- Nonprofits using The Giving Block’s crypto fundraising platform can automatically generate Form 8282.

What is IRS Form 8282?

Charitable organizations use IRS Form 8282 to report the sale, exchange, consumption or disposal of property for charitable purposes. A donee organization that sells the donated property within three years of receipt has an obligation to file Form 8282.

According to the IRS, there are two situations in which Form 8282 does not have to be filed:

- Items are valued at $500 or less.

- Items are consumed or distributed for charitable purposes.

Unless the above exceptions apply, it is generally understood that the organization must file IRS Form 8282 within 125 days after the date of disposition.

How to File Form 8282

First, the basics. Charitable organizations are required to complete and file Form 8282 with the IRS and provide a copy to the donor.

A completed IRS Form 8282 should be sent in a timely manner to:

Department of Treasury,

Internal Revenue Service Center

Ogden, UT 84201-0027

If your nonprofit accepts cryptocurrency donations, here are your options for completing Form 8282:

- Do it yourself. You can find and download a copy of Form 8282 on the IRS website and fill it in yourself.

- Get help. Use The Giving Block to accept cryptocurrency donations and automatically generate a completed Form 8282 after receiving a crypto donation.

Consider this: would you rather add more administrative work for your team, or spend more time focused on your mission?

Source: Internal Revenue Service.

Tap into the Possibilities of Crypto Fundraising

Crypto donations help nonprofits achieve positive fundraising outcomes and make an impact where it counts most.

Choosing the right crypto fundraising platform can be the difference between being confused by crypto versus being empowered to steward crypto donors, leverage the potential of NFTs as a fundraising tool, and tap into the “web3 for good” movement.

As the leading solution for nonprofits fundraising cryptocurrency, The Giving Block’s platform includes tools and services to help your team thrive, with offerings like:

- Automatic Form 8282 generation for donations

- Auto-sell crypto donations for cash upon receipt

- 5000+ integrations with popular CRMs and workflows

- Donation dashboard to track the gifts you receive

- Hands-on support from crypto fundraising experts

The Giving Block team made set-up super easy and assured a smooth donor experience from crypto gift to receipting, and our Finance team especially appreciates the platform’s autosell conversion to cash.

If your organization is ready to see more about how our platform and support helps nonprofits succeed in crypto fundraising, reach out to our team today.

Disclaimer: This article was written for general informational purposes only, and is not financial advice. Please consult with a qualified tax advisor regarding your organization’s specific needs and responsibilities.