The dual pressures of inflation and recession present unique challenges for nonprofits. Inflation erodes the purchasing power of every donated dollar, while economic downturns tighten individual and corporate budgets. However, history demonstrates that organizations adopting agile and strategic approaches can not only survive but also emerge stronger. Recent data highlights the urgency: while charitable giving reached a significant nominal figure in 2023, its real-dollar impact was diminished by inflation, underscoring the need for smarter fundraising.

Understanding the Current Fundraising Climate

Navigating today’s economic landscape requires a clear understanding of key trends:

- Inflation-Adjusted Giving Matters: While nominal giving figures might appear stable or even rise, understanding the real-dollar value of donations is crucial. For instance, if 2023 nominal gifts increased, but real-dollar giving (adjusted for inflation) declined, it means your organization’s purchasing power for programs and services has decreased, squeezing budgets. This transparency is vital for internal planning and donor communications.

- Forecasts Still Signal Opportunity: Despite economic uncertainty, projections for charitable giving often remain positive. For example, The Philanthropy Outlook has projected inflation-adjusted increases in giving for upcoming years. This indicates that donors remain committed to causes that clearly articulate their value and impact. The key is to communicate your mission’s enduring relevance effectively.

Takeaway for Fundraisers

Always track and report giving in real (inflation-adjusted) dollars to your board, staff, and donors. This provides a more accurate picture of your organization’s financial health and the true impact of their support. Contextualize nominal growth with real-dollar impact to manage expectations and celebrate true wins.

Tailoring Donor Messaging for Economic Uncertainty

In times of economic stress, your communication must be empathetic, transparent, and impact-driven.

Lead with Empathy and Undeniable Impact

- Acknowledge the broader economic pressures your donors may be facing, such as rising cost-of-living. This builds trust and shows you understand their reality.

- Crucially, translate every donation into tangible, vivid outcomes. Instead of just stating “your $50 helps,” articulate it as: “$50 ensures one family has safe, temporary housing for a week,” or “$100 provides a month of nutritious meals for a vulnerable senior.” Quantify and humanize the impact.

Using your #CryptoForGood is easy with our #WaterWAGMI Fund👇 pic.twitter.com/Ig4E9YjH7l

— WaterAid America (@WaterAidAmerica) February 2, 2025

Emphasize Inflation-Resilient Giving Options

- Promote Recurring Gifts: Encourage monthly or quarterly donations, ideally linked to a specific, measurable impact (e.g., “$25 a month provides essential supplies for a child’s education for an entire year”). These provide predictable revenue streams and allow donors to spread their support.

- Spotlight Non-Cash Assets: Educate donors on the benefits of giving appreciated assets like cryptocurrency and stock donations. Even in volatile markets, these assets may have grown in value, allowing donors to avoid capital gains taxes while making a significant gift. Check out: The Giving Block’s Crypto 101 Fundraising Guide for more information.

- Donor-Advised Funds (DAFs): Many donors hold significant funds in DAFs. Provide clear pathways and messaging on how they can recommend grants from their DAFs to support your mission, especially highlighting your organization’s ability to maximize impact despite inflation.

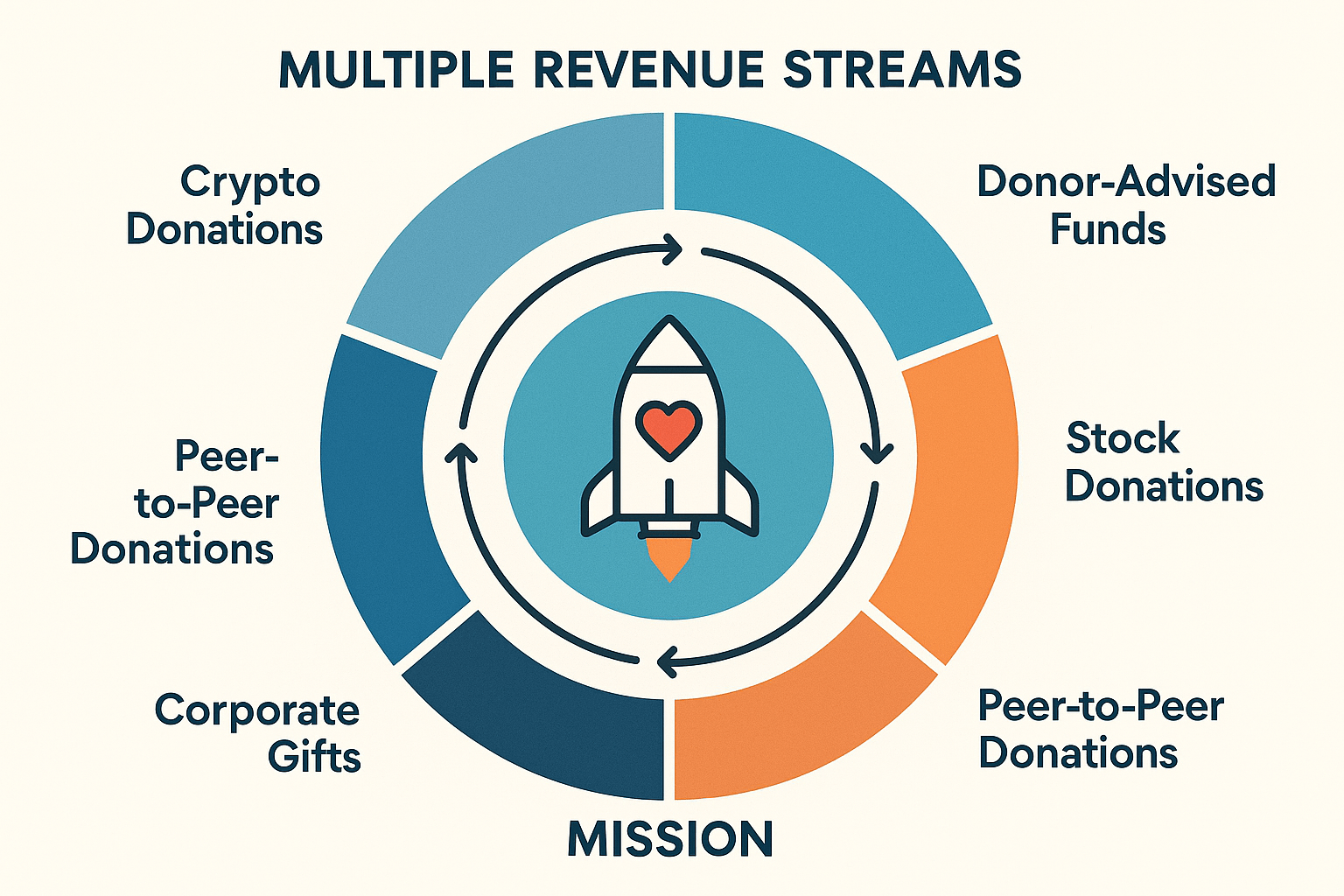

Diversify Revenue Streams Before Donations Dip

Proactive diversification is a nonprofit’s best defense against economic volatility. Don’t wait until the well runs dry.

| Diversification Idea | Quick Win |

|---|---|

| Corporate Matches & Payroll Giving | Launch a "Double Your Impact" microsite or campaign. |

| Peer-to-Peer Campaigns | Empower supporters to fundraise for their birthdays or personal challenges. |

| Donor-Advised Funds (DAFs) & Foundations | Submit a concise "inflation impact brief" detailing your urgent needs. |

| Earned Income & Social Enterprise | Explore mission-aligned products, services, or events with a fee. |

Cost-Effective Tactics When Budgets Tighten

Maximizing every dollar is paramount during inflationary periods.

- Automate Low-Lift Stewardship: Implement email journeys and SMS thank-you messages for donor segments, freeing up staff time for high-value engagement.

- Leverage Free or Discounted Technology:

- Utilize Google Ad Grants for free advertising.

- Access design tools like Canva (often with nonprofit discounts).

- Explore platforms like GitHub Sponsors if your nonprofit is aligned with open-source software development.

- Lean into Volunteer Talent: Empower your dedicated volunteers to take on higher-level roles in content creation, graphic design, social media management, or even peer-to-peer fundraising acceleration.

- Optimize Ad Spend with A/B Tests: Continuously test different ad creatives, audiences, and calls to action. Quickly reallocate budgets from underperforming segments to those yielding the best return on investment.

Strengthen Stewardship & Retention

Retaining existing donors is significantly more cost-effective than acquiring new ones, especially in a challenging economy.

Use Data to Highly-Engaged Supporters

Blackbaud’s 2024 report indicates that mid-level and major donors are increasingly shouldering a larger proportion of total giving, even as the number of small-gift supporters might fluctuate. This trend underscores the importance of:

- Prioritizing Retention Efforts: Focus your limited resources on cultivating and retaining these vital segments.

- Personalized Outreach: Utilize donor data to understand giving patterns, interests, and communication preferences for highly personalized stewardship.

Celebrate Long-Term Relationships

Show your appreciation in meaningful ways that go beyond standard thank-yous:

- Send Personalized “Inflation-Impact Updates”: Share how their past and ongoing support is helping your organization navigate economic challenges and continue to deliver critical services.

- Offer Behind-the-Scenes Virtual Tours: Provide exclusive online events or virtual glimpses into your programs, allowing donors to see their impact firsthand and strengthen their emotional connection.

- Handwritten Notes & Personal Calls: These simple, high-touch gestures can significantly boost retention rates.

Measuring Success in Real Dollars

To truly understand your financial health and impact during inflation, go beyond nominal revenue figures.

- Create Dynamic Dashboards: Develop internal dashboards that not only chart nominal revenue but also visualize your inflation-adjusted purchasing power. This transparency is crucial for:

- Board Confidence: It provides your board with a realistic picture of your financial standing.

- Informed Decision-Making: It clearly indicates when expense cuts, new revenue initiatives, or programmatic adjustments are necessary to maintain momentum.

Ready to future-proof your fundraising and ensure your mission thrives, even in an uncertain economy? Book a free strategy session with The Giving Block’s nonprofit experts today and start implementing recession-resilient strategies that truly make a difference.

Book a Meeting