Ever wonder how some nonprofits seem to secure larger and larger donations every year? With over a million nonprofits in the U.S., we all can’t get those nine-figure gifts from Mackenzie Scott. And sure, a giant budget, extensive board network, and large fundraising team would be nice, too. But there’s one thing that every single nonprofit can do right now: optimize their fundraising goals around specific metrics.

By tracking several data points each year, fundraisers can pinpoint critical areas for improvement and discover which tactics they should double-down on to maximize revenue. This works for the biggest global charities to the smallest local food banks.

Below you’ll find a dozen major gifts metrics that can help your team engage and steward donors effectively.

How to Start Tracking Fundraising Performance Metrics

Which fundraising KPIs are most important to measure for your nonprofit’s success? In truth, it depends on the current state of your major giving program. If your organization has just hired its first major gifts officer, you can build a solid foundation for future growth by tracking as many as possible.

On the other hand, if you already have a fully developed major giving program, your team might be more selective. If that’s your case, feel free to scan the list below to identify some fundraising performance metrics you don’t currently track.

1. Donation “Asks” Made

Asks made refers to the total number of donation requests that you make to a donor or group of donors. This metric tracks how proactive your fundraising efforts have been. Tallying up a grand total of asks is one way to measure this metric, but you can also drill down to look at particular types of donors or campaigns.

How to measure it: Keep a spreadsheet of asks made to specific donors with the date, the nature of the request, and the outcome. (Your CRM may also have a field that allows you to track this for each contact in your database.)

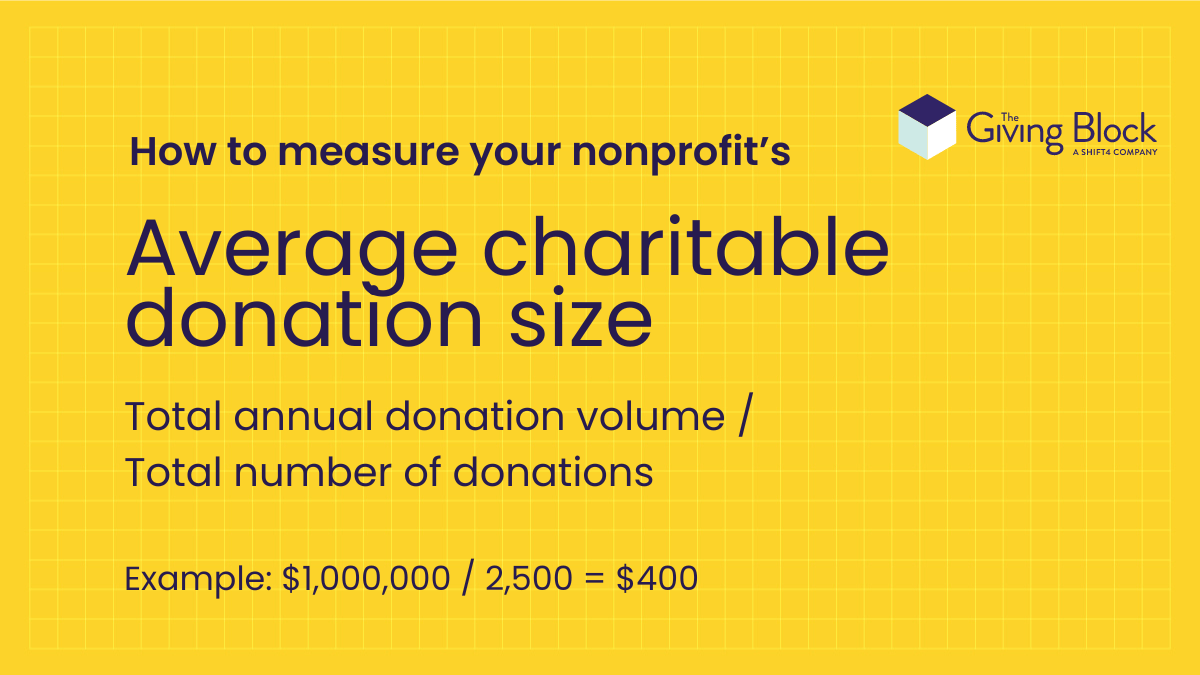

2. Average Gift Size

Your average gift size says a lot about your organization’s donor stewardship. For one thing, it is the clear line that separates your larger, major gifts from your smaller gifts. Knowing your average gift size is the starting place for eventually segmenting your donor lists into different giving tiers, which can empower you to make the appropriate ask of each donor in your communications and touchpoints.

How to measure it: Divide your total annual donation volume by the total number of donations.

3. Average Gift Size Growth

Have your donors increased their giving over time? Calculate your average gift size growth to find out. By examining your donors’ giving histories, you can forecast their potential future gift sizes. Increases over time can suggest that you are effectively nurturing your donor and demonstrating the impact of their generosity. Dips or steady declines may signal that there is work to be done to repair the relationship.

How to measure it: First, calculate your nonprofit’s average gift size for two consecutive years. Then, you will need to run a formula to determine the percentage increase between the two. (You can also measure individual donors’ individual giving.)

4. Average Giving Capacity

Wealth screening tools can help you find your donors’ average giving capacity. A capacity rating represents “the total amount the prospect can give to all causes over a 5 year period.” Fundraisers use the average giving capacity of your major donors to set realistic funding goals and identify targets for donor acquisition.

How to measure it: There is no single formula for this, but using a wealth screening tool can greatly increase the accuracy of your estimates. With some research, your team can establish a giving capacity baseline for your major giving prospects. Adding up the giving capacity of each prospect and dividing by the number of prospects will give you your average giving capacity score.

5. Gift Frequency

Gift frequency refers to the number of donations made over a period of time. Some major donors pledge to give annually, while others may make large gifts every five years. Others may leave a large planned gift in their wills.

How to measure it: To calculate gift frequency across your entire donor database, add the number of times your donors make a gift each year, then divide by the number of donors.

6. Major Donor Dependency Rate

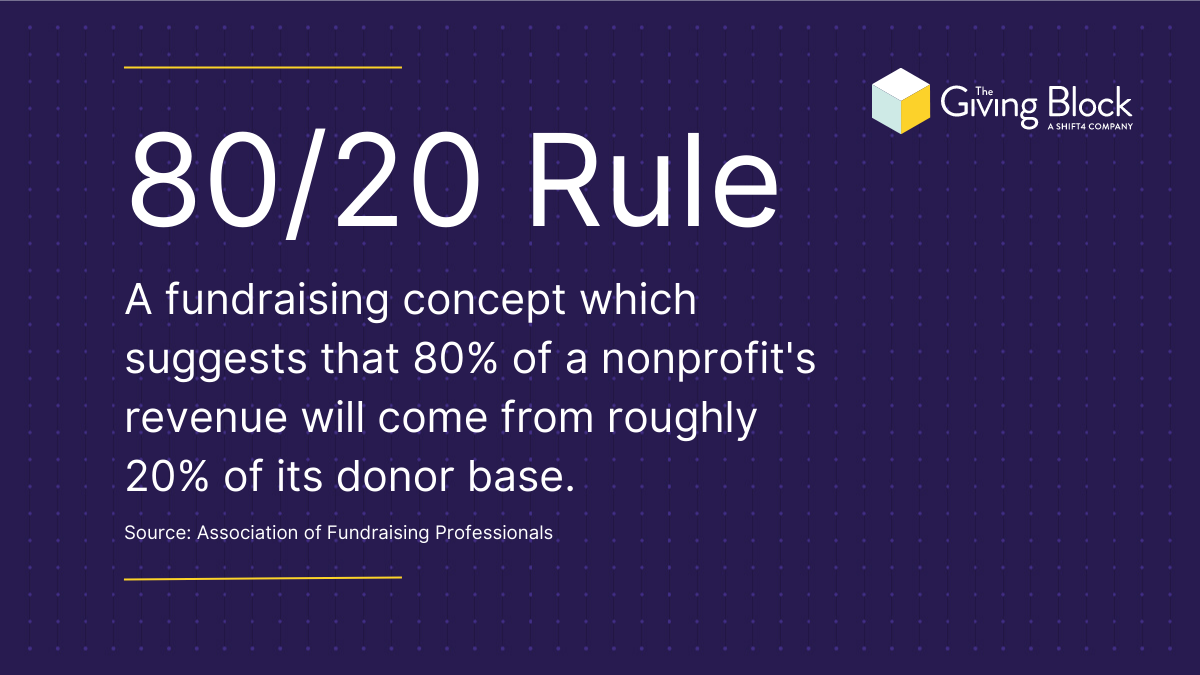

Your nonprofit’s major donor dependency rate can show you how much you rely on major donors for fundraising. Are you familiar with the Pareto Principle, an economics concept? Applied to fundraising, it suggests that many nonprofits see roughly 20% of their donors contributing about 80% of their annual fundraising revenue.

Is that a good thing? It depends. Achieving the “80/20” ratio can be a good target to aim for if you want to maximize the impact of donors with the greatest giving potential. However, you may also want to double-down on new donor outreach so you’re not putting “all of your eggs into one basket.”

How to measure it: First, sort your donors in order of donation volume. Add up the donation volume of your top 20% of donors, and divide that figure by your total donation volume and multiply by 100. The result is the percentage of your overall donation volume that your biggest donors contribute.

7. Major Donor Acquisition Rate

Major donor acquisition rate tracks the success of converting your giving prospects into actual donors. Is your major donor cultivation paying off? Are you getting donations of the size that you’re asking for?

How to measure it: Divide the number of new major donors by the number of prospects that you contacted this year during your donor stewardship efforts.

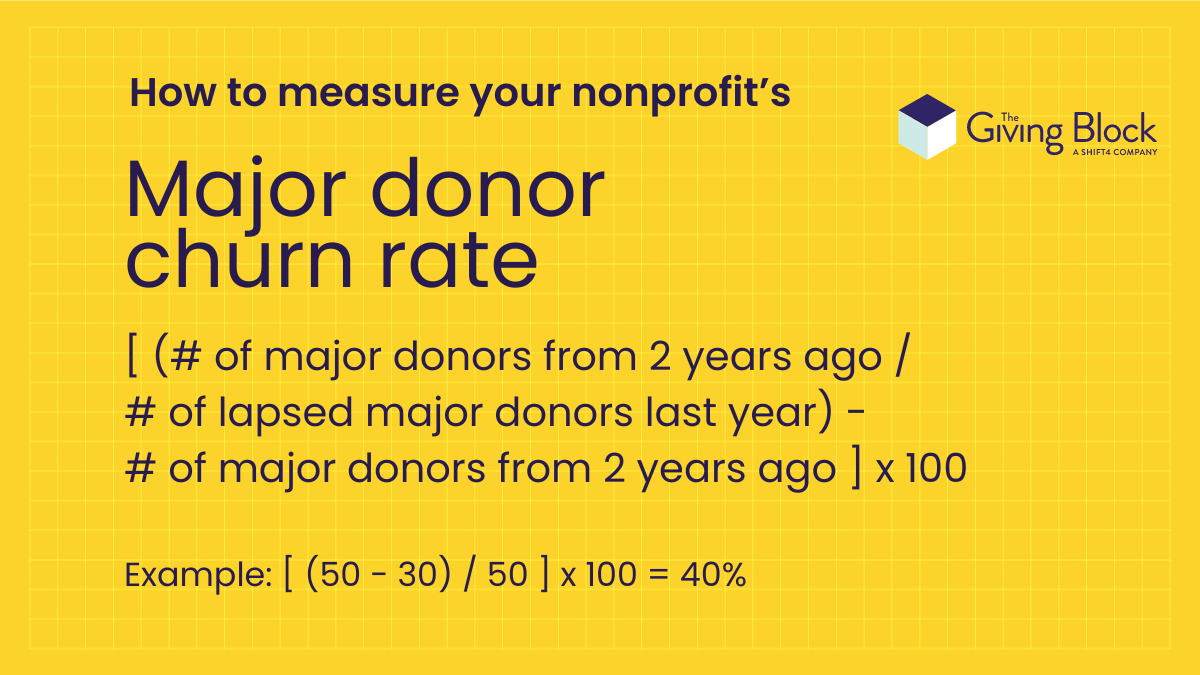

8. Major Donor Churn Rate

Churn rate is the percentage of active donors that become inactive in a single calendar year. Your nonprofit may have donors that did not give last year but have pledged to give in a future year. If so, you may want to remove them from the calculation. Ultimately, you want your churn rate as low as possible.

How to measure it: Pull a report of your donors who gave to your nonprofit two years ago. Then, mark all of the donors from that list who did not give last year. Divide the second number by the first number, then multiply by 100.

9. Average Major Donor Lifespan

Averaging out the giving lifespan of your biggest donors can be a gateway to several other eye-opening insights. First, you’ll want to know if the bulk of your major donors support your nonprofit for years, decades, or even generations (thanks to donation vehicles like planned gifts, trusts, estates and Donor-Advised Funds).

After you have a sense of your donor lifespan, use the exercise as a springboard for other data points, such as how many years it takes for your donors to become major donors, and what percentage of their lifespan is spent as a major donor.

How to measure it: Get a list of your active major donors. If your donor data is well-maintained, you will have a record of the date of your donors’ first gifts and most recent gifts. Create a column in your spreadsheet called “Donor Lifespan.” In those cells, subtract the value of the most recent donation date from the first donation date. Calculate an average of those numbers.

10. Lifetime Donor Value

Donor lifetime value helps your organization get a general understanding of your donors’ total long-term impact. While not necessarily a fundraising “health metric,” it can help your organization strategize about where to allocate campaign resources.

How to measure it: Multiply your nonprofit’s average donor lifespan, average donation size, and the average frequency of donation of your donors.

11. Gifts Secured

At the end of your fiscal year or a campaign, run a report to determine how many gifts your organization received from donors. If you drill down into specifics, such as donor segments or gift types (e.g. crypto donations, major gifts, DAF grants), you will be able to better understand the success of your appeals to different audiences.

How to measure it: Tally up the total number of donations received overall (or for a specific gift type, campaign, or a unique donor segment).

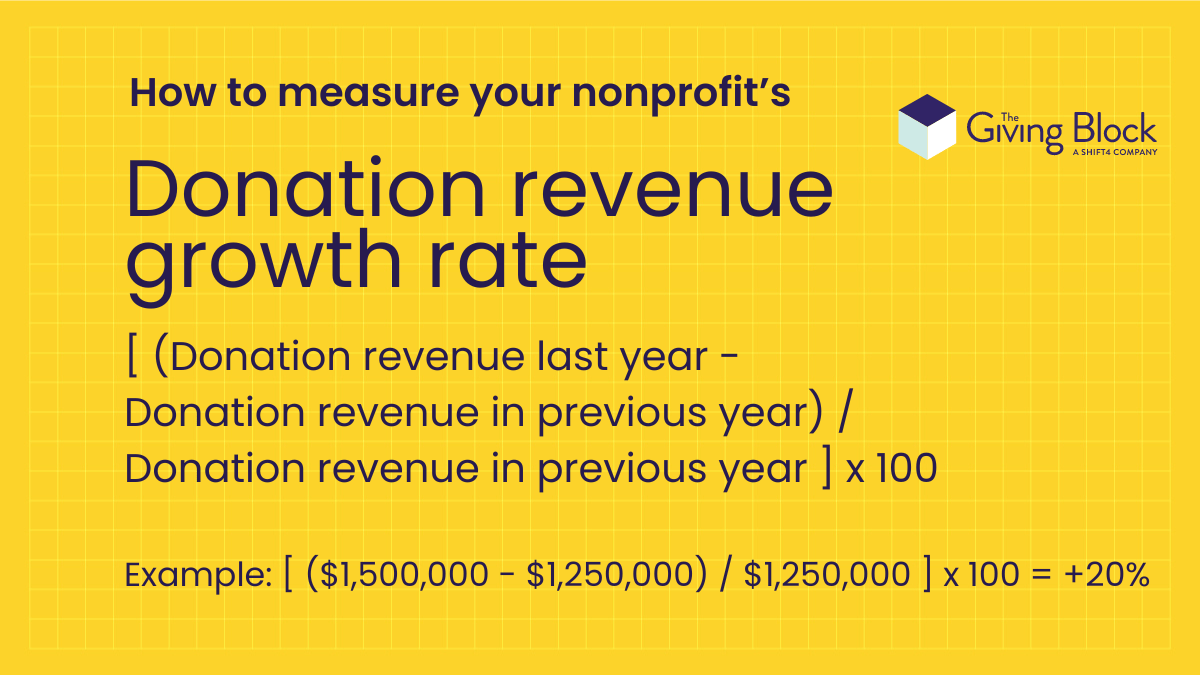

12. Donation Revenue Growth Rate

Donation revenue growth rate measures your organization’s the changes to your annual fundraising volume over time. This KPI is typically measured as a percentage in yearly increments, such as 1-year, 3-year, and 5-year periods. This can give you a bird’s eye view of your whether your total fundraising efforts are increasing the value of the donations you receive in return.

How to measure it: Calculate the most recent year’s donation revenue, and subtract the previous year’s revenue. Divide that number by the previous year’s revenue. Multiply that number by 100.

Conclusion

Your major gifts roadmap will speak to a unique set of needs, such as investing in a modern CRM, launching campaigns for specific donor segments, using wealth screening tools to identify new prospects, or adding new ways for your donors to give.

After you calculate your most important fundraising benchmarks, your nonprofit can develop strategic, measurable goals to increase your major giving revenue. Our advice? Avoid comparing your outcomes to other nonprofits, prioritize growing your annual donation volume, and stay committed to improving donor relationships and acquiring new donors.

Ready for a new approach? Consider strengthening your stock fundraising strategy or introducing a crypto donation method for your supporters. Not only do these giving methods tend to yield larger-than-average donations, they’re also a great way to expand your digital fundraising footprint. Learn more about non-cash asset fundraising today.