An NBC survey from 2022 suggests that one in five Americans has used cryptocurrencies like Bitcoin. That’s roughly 66 million crypto users in the U.S. alone. If you’re one of them, it’s your responsibility to report any crypto gains when you file your taxes. By donating appreciated cryptocurrency to a registered nonprofit, you can potentially lower the taxes that you would otherwise incur on your crypto activity.

Disclaimer: Please note that we at The Giving Block are not financial advisors, tax accountants or attorneys; we just love helping nonprofits accept cryptocurrency donations. This article should not be considered financial or legal advice. Every person’s situation is different and we strongly recommend that you talk to your accountant, attorney or financial advisor before making any major financial decisions.

How is Cryptocurrency Taxed?

In the United States, the IRS treats cryptocurrencies as property (like stocks) for tax purposes. As a result, cryptocurrency transactions are subject to the capital gains tax. If you have held a crypto asset for less than one year before selling or trading it, any appreciation is subject to the short term capital gains tax. If you held it for over a year, it’s considered a long-term capital gain. Each of these have unique tax schedules and rates.

Are Crypto Donations Considered Taxable Events?

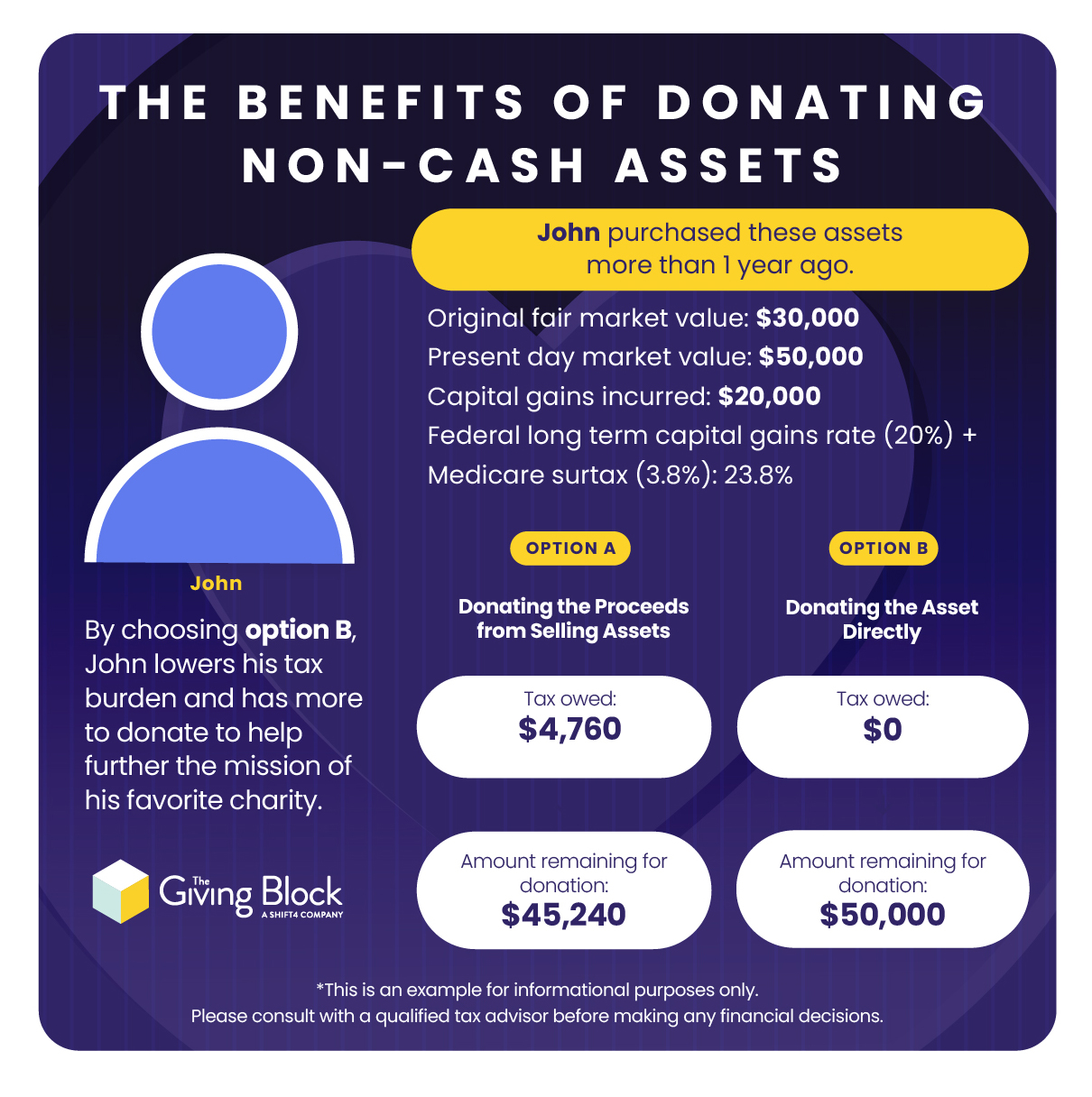

While disposing of a cryptocurrency (i.e., selling it for cash) is a taxable event, it is generally understood that donating cryptocurrency to a charity is not a taxable event.

How Do Cryptocurrency Donors Benefit?

Cryptocurrency donations to 501(c)3 nonprofits are considered tax-deductible and do not trigger a taxable event, meaning you do not usually have to pay capital gains tax. For US donors, you should report your donation to the IRS to realize these tax benefits.

Even if you want to donate crypto anonymously, you really should consider taking advantage of the tax benefits and ask for a donation receipt. You can protect your anonymity from the nonprofit by using something like a protonmail email address, but you’ll still need to report the charitable donation to the IRS.

How Can I Donate Cryptocurrency?

Thousands of nonprofit organizations accept cryptocurrency donations, from large charities to local food banks. Explore the nonprofits using The Giving Block’s fundraising platform today to accept hundreds of cryptocurrencies.