Crypto Philanthropy is one of the fastest-growing revenue sources for nonprofits, and The Giving Block now offers even more non-cash fundraising solutions for charitable organizations of all sizes.

Beyond giving cash and cryptocurrency, your donor community can also donate stocks to help fuel your organization’s mission. Although stock donations may have been complicated for donors in the past, The Giving Block has made it easy for donors to support your nonprofit with their non-cash assets, and just in time for the year-end giving season.

Accepting gifts of publicly traded stock can boost your nonprofit organization’s fundraising efforts and help you grow revenue even faster. It also attracts more donors who are looking to make large and oftentimes recurring gifts.

Learn why your organization should start accepting stock donations today, and how The Giving Block makes the process simple so your team can stay focused on your mission.

Three Key Benefits of Accepting Stock Donations

Stock Donations Increase Revenue Faster

Nonprofits that accept stock donations have increased their fundraising revenue up to 55% faster than organizations that only accept cash. Non-cash donation options make a noticeable difference to organizations who are seeking to grow and diversify their revenue streams.

A study of IRS-990 forms conducted by fundraising expert Dr. Russell James showed that over a five year period, organizations experienced more growth by accepting non-cash gifts and securities:

- Nonprofits that accepted non-cash gifts saw a 50% growth over nonprofits that accepted only cash donations.

- Nonprofits that accepted non-cash securities saw a 66% growth over nonprofits that accepted only cash.

These results applied to organizations at all fundraising levels, whether they were raising $100,000 or $10 million.

Accepting Stock Leads to Larger Gifts

Offering stock donations as an option to your donor base may increase the size of your gifts significantly.

That’s because donations of non-cash assets tend to be larger than cash donations. Here are two of the more obvious reasons for this trend:

First, donating publicly traded stock comes with attractive tax benefits, creating an incentive for donors to make larger gifts to the charities they care about. Secondly, according to the U.S. Census, a staggering 90% of U.S. household wealth is estimated to be held in non-cash assets.

While donating via credit card or check may seem easier, the reality is that stock donations are better optimized for how your donors actually hold most of their wealth and their opportunities to lower their taxes.

Stock Donation Options Encourage Continual Giving

By allowing stock donations, donors have the opportunity to make continual giving part of their overall wealth planning. That same study by Dr. Russell James also showed that donors are more likely to donate from their wealth portfolio versus their cash holdings. Nonprofits can appeal to these donors wishing to gift assets from their portfolio rather than their savings account.

Finally, donors who make non-cash asset gifts generally consider these assets first when they make subsequent contributions to a nonprofit. Organizations can cultivate long-term relationships with these donors by providing the opportunity to give non-cash assets.

How to Accept Stock Donations

Stock donation processing is available to The Giving Block’s nonprofit customers that have 501(c)(3) status and are U.S. based, as well as all charitable organizations who meet that criteria and subscribe to The Giving Block’s flagship crypto fundraising solution in the future.

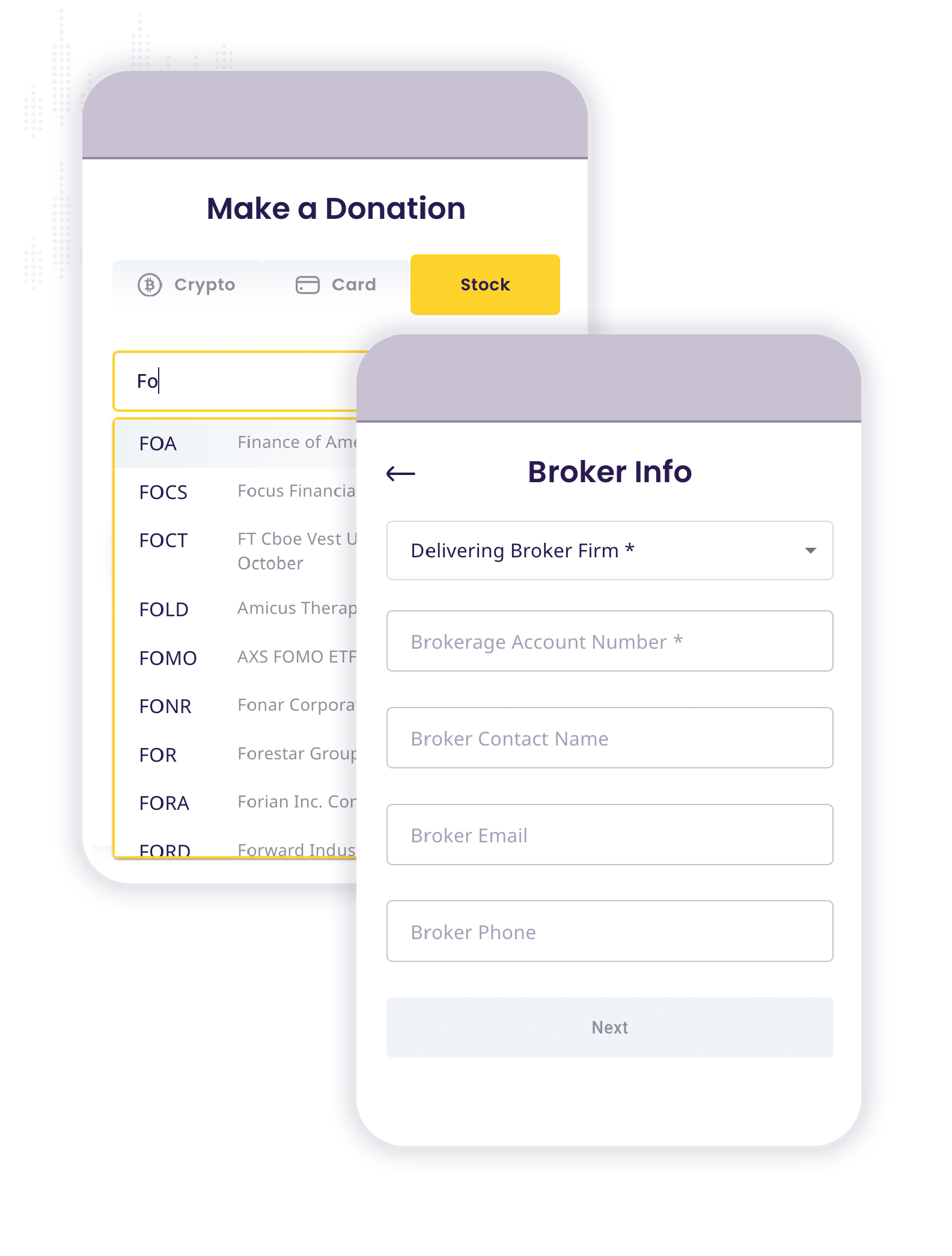

The Giving Block makes stock donations easy; the option to donate stocks is available to donors via The Giving Block Donation Form. The donation process can be completed in several easy steps—all donors have to do is select from a wide range of ticker symbols for the stock they wish to donate, select the amount, and provide brokerage information. Details are sent to the broker to finalize, and once the donation is processed, donors receive a tax receipt.

Through The Giving Block, your organization receives all the technology and fundraising support you need to accept stock donations, without any additional headcount or operational lift necessary. Donors will be able to donate stocks through both The Giving Block’s Donation Form on your organization’s website and your nonprofit’s donation page on thegivingblock.com.

Start Accepting Stock Donations Today

Stock donations help your organization boost revenue, secure larger gifts, and cultivate relationships with recurring donors. The Giving Block makes it easy for both your organization and your donors to further your cause through non-cash gifts.

As your organization taps into this additional fundraising revenue source, remember to share the news with your donor community and spread the word that it’s easier than ever to support your critical mission.