Giving to charity is as easy as finding a cause to support and donating some cash, right? Not so fast. Donating with your credit card might seem like a no-brainer, but given that 90% of U.S. household wealth is held in non-cash assets, you might be picking the wrong assets to donate if you’re limiting your charitable giving to cash.

By choosing the right asset to donate to charity, you can unlock big potential tax savings. What’s more, a growing number of nonprofits and charities are welcoming crypto and stock donations from their supporters. Here are some factors to help you decide which giving method is best for you:

1. After-tax proceeds limit donation size

Nonprofits typically accept several forms of charitable donations. But while “give what you can” is the general saying, you may be limiting what you can give by only donating cash.

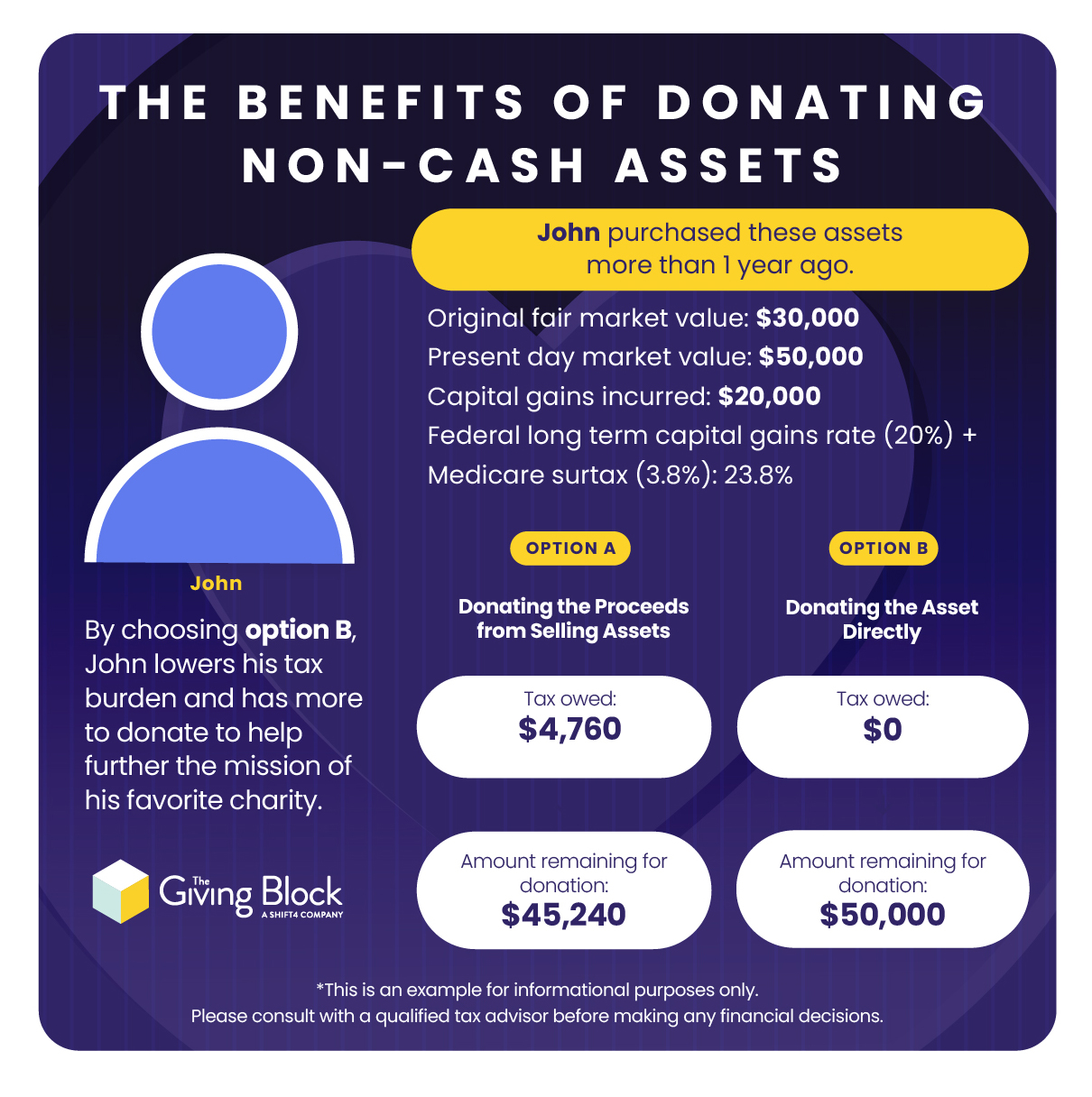

For example, if you sell a portion of your stock portfolio and donate a percentage of your after-tax proceeds, that can be significantly less than if you had donated some of that asset directly to the organization of your choice.

2. Stress-free giving

Selling non-cash assets in your portfolio in order to make a donation is often an extra, unnecessary step. Not only can doing so add time to your donation process, there is also the question of the tax implications, as mentioned above.

Today, non-cash giving is not the antiquated process with lots of red tape that it once was. Instead, thousands of nonprofits actively fundraise crypto and stock donations, thanks to platforms like The Giving Block that streamline the process to empower the modern philanthropist to give their preferred assets with greater ease.

3. Non-cash donations have big tax benefits

When most people think about giving to charity, they think about (1) the impact on the cause they are supporting, and (2) the tax benefits of the donation. Taxpayers in the US and several other countries have greater tax incentives to donate a non-cash asset directly to a charitable organization than they do if they were to donate cash.

As noted on a resource from JP Morgan, donating appreciated assets “has a benefit that does not apply to cash donations—you completely avoid paying capital gains tax on the appreciation.”

Why is that? In essence, the IRS treats cryptocurrency like property for tax purposes, meaning that donated non-cash assets like stock or crypto are typically not subject to long-term capital gains tax, which can be as high as 20%.

Bottom line: Cash is not always king

Most people instinctively reach for their checkbook or credit card when they want to donate. Instead, you can maximize the impact of your giving—for both you and your favorite charity—when you consider giving non-cash assets, which are often overlooked.

Using modern donor solutions like The Giving Block can help you donate non-cash assets with more confidence and ease.

Disclaimer: This article does not contain or purport to give financial advice. Speak to a qualified advisor about your unique financial situation.