A recent wave of new giving methods has opened the door for charities to boost their annual fundraising revenue. One relatively new option, the Donor-Advised Fund, is now a $234 billion dollar opportunity that shows no signs of slowing down. In fact, total charitable assets in Donor-Advised Funds have grown a staggering 17% annually over the past decade.

The popularity of Donor-Advised Funds (aka “DAFs”) has as much to do with the tax advantages as it does with the potential to grow the value of DAF-deposited assets before granting them to a charity.

Curious to know how your nonprofit can raise more with Donor-Advised Funds? Explore our guide below to learn how DAFs work, and understand the pros and cons for both donors and nonprofits.

As a bonus, we’ll also share a few tips to help you ask for and accept DAF donations with ease and efficiency.

What’s Inside:

- What is a Donor-Advised Fund?

- How Do Donor-Advised Funds Work?

- Donor-Advised Funds: Pros and Cons

- The Tax Benefits of Donor-Advised Funds

- In Comparison: Donor-Advised Funds vs. Other Giving Vehicles and Entities

- Donor-Advised Funds: Top Trends and Stats (2023)

- Boosting Your Nonprofit’s Revenue with DAF Donations

What is a Donor-Advised Fund?

A Donor-Advised Fund is an account where you can deposit and manage cash and non-cash assets that are reserved for future charitable giving. These funds are highly popular among individual donors because of the ease of administration and potential tax savings from donating to a Donor-Advised Fund. Donor-Advised Funds also allow deposited assets to grow over time, thereby enabling donors to grant charities a greater sum than the original value of their assets.

Who Donates via DAFs?

Individuals, families or groups can create and/or contribute to a DAF account. They will then advise their DAF provider how the assets will be invested via grants to nonprofits. Donors can typically indicate if the gift is unrestricted or designated to a specific cause or program.

How Do Donor-Advised Funds Work?

Donor-Advised Funds are powerful giving vehicles for philanthropists and a major giving source for all types of charitable organizations. But there are specific guidelines to follow, from setting up a DAF to making a grant from a fund.

Getting Started: How to Create a Donor-Advised Fund

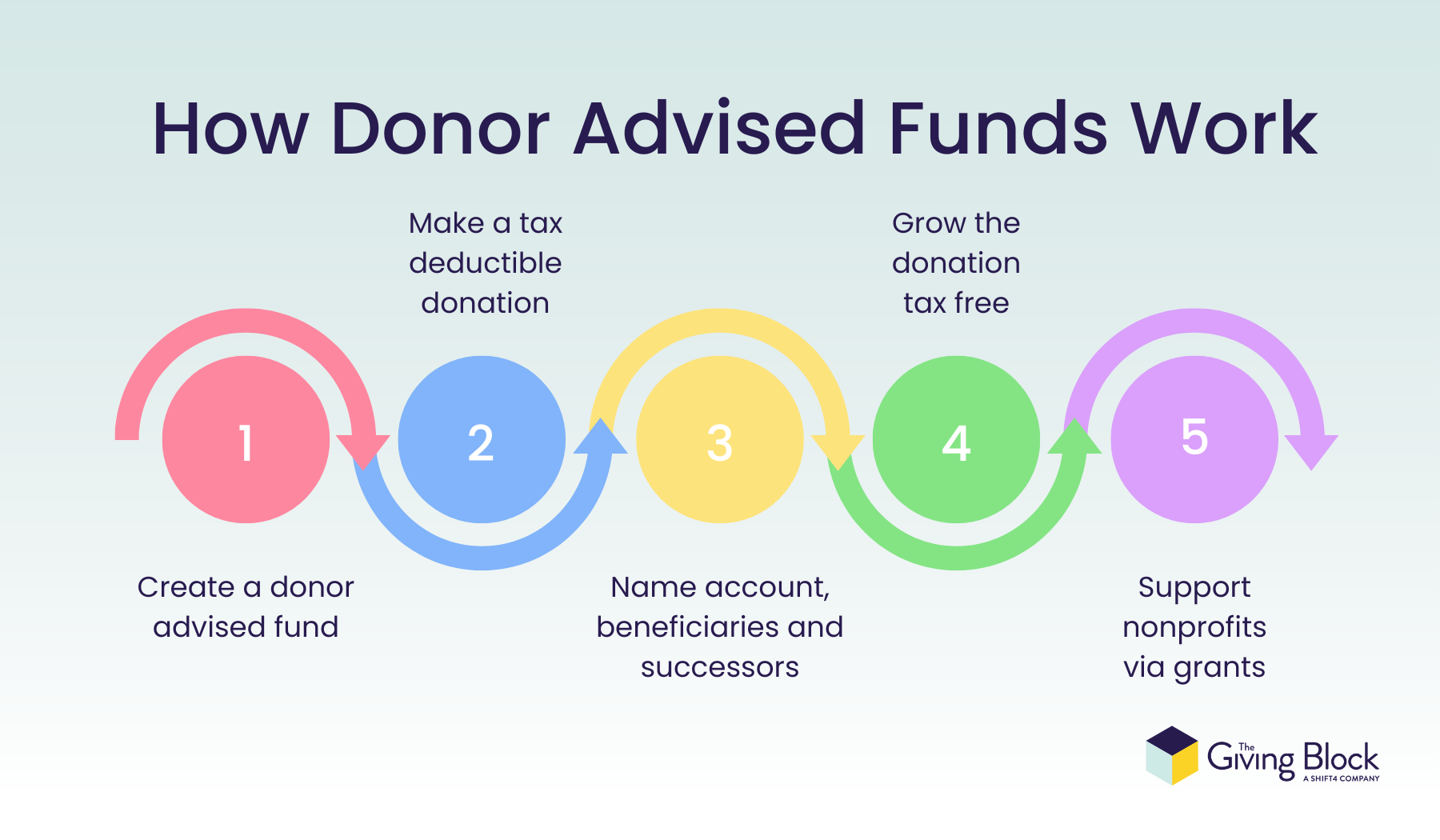

Here’s the typical five-step process on how donors set up a Donor-Advised Fund, and how a charity eventually receives a donation from a DAF:

1. Create a Donor-Advised Fund

To set up a Donor-Advised Fund, donors need to pick a charitable sponsor (or sponsoring organization). The most commonly used sponsor types include:

- National Charities (Example: Renaissance Charitable Foundation)

- Community Foundations (Example: Austin Community Foundation)

- Single-Issue or Single-Recipient Charities (Example: The University of North Carolina at Chapel Hill Foundation, Inc.)

Note that each sponsor may have unique minimum deposit requirements, associated fees, restrictions on beneficiary types, and other rules or guidelines.

2. Make a tax deductible DAF donation

Once your fund is open, you will need to make a contribution to your DAF in the form of cash or a non-cash asset. These are a few types of assets that can be donated:

- Cash

- Stocks

- Real estate

- Cryptocurrencies

- Mutual funds

- Non-publicly traded assets

The tax benefits are one of the biggest advantages of using Donor-Advised Funds. As such, DAF donors receive an immediate tax deduction for gifts made to their Donor-Advised Funds.

Why donate a non-cash asset to a DAF? Donors are not required to pay capital gains on any appreciated non-cash assets (like crypto) that are donated to a Donor-Advised Fund, making it a highly tax-efficient way for savvy investors to give back.

3. Name account, beneficiaries, and successors

To complete the initial setup, a Donor-Advised Fund needs a name and at least one beneficiary and successor. A beneficiary is a charity that will eventually receive funds from the account, while a successor is anyone who will take over the account if the owner passes away.

4. Grow donations tax-free in your fund

Assets deposited into Donor-Advised Funds can be invested for growth, with no restrictions on how long these assets can remain in the account. That means donors have the potential to see their contributions increase in value over time. Over time, grants from Donor-Advised Funds can exceed the original value of the donated assets.

5. Support nonprofits via DAF grant recommendations

Once assets are donated to a Donor-Advised Fund, they can be directed to qualifying charitable organizations via grants or grant recommendations. Grants can be made on a rolling basis, or else a beneficiary can be named that will receive assets in a fund once the owner passes away.

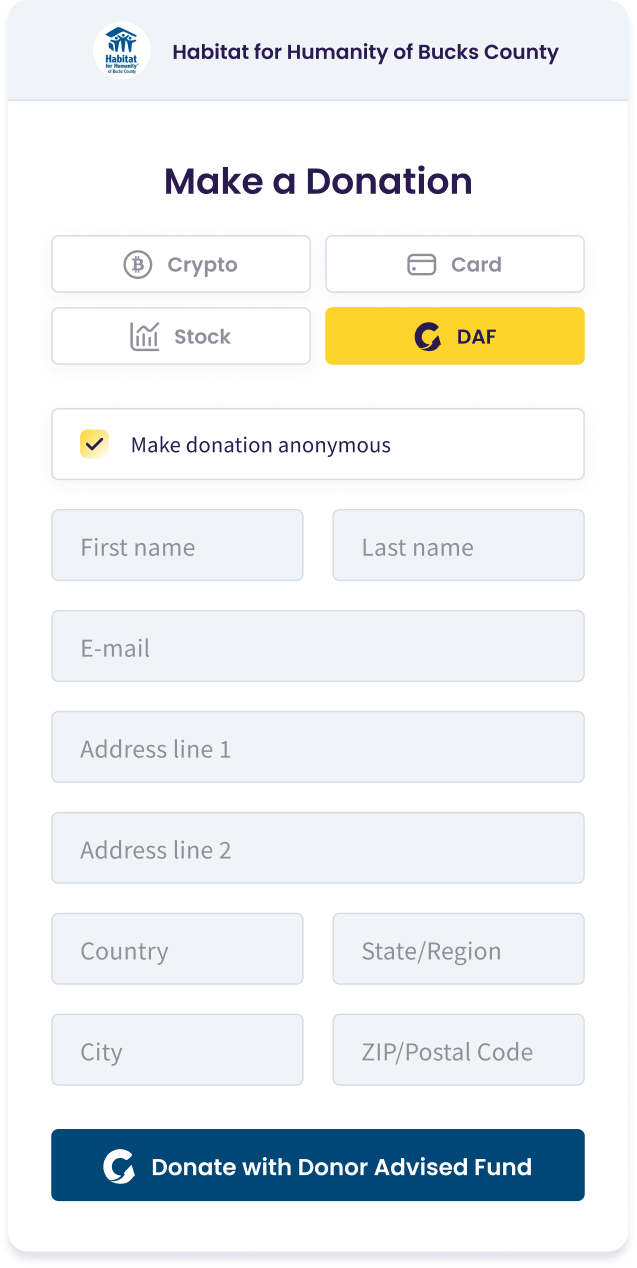

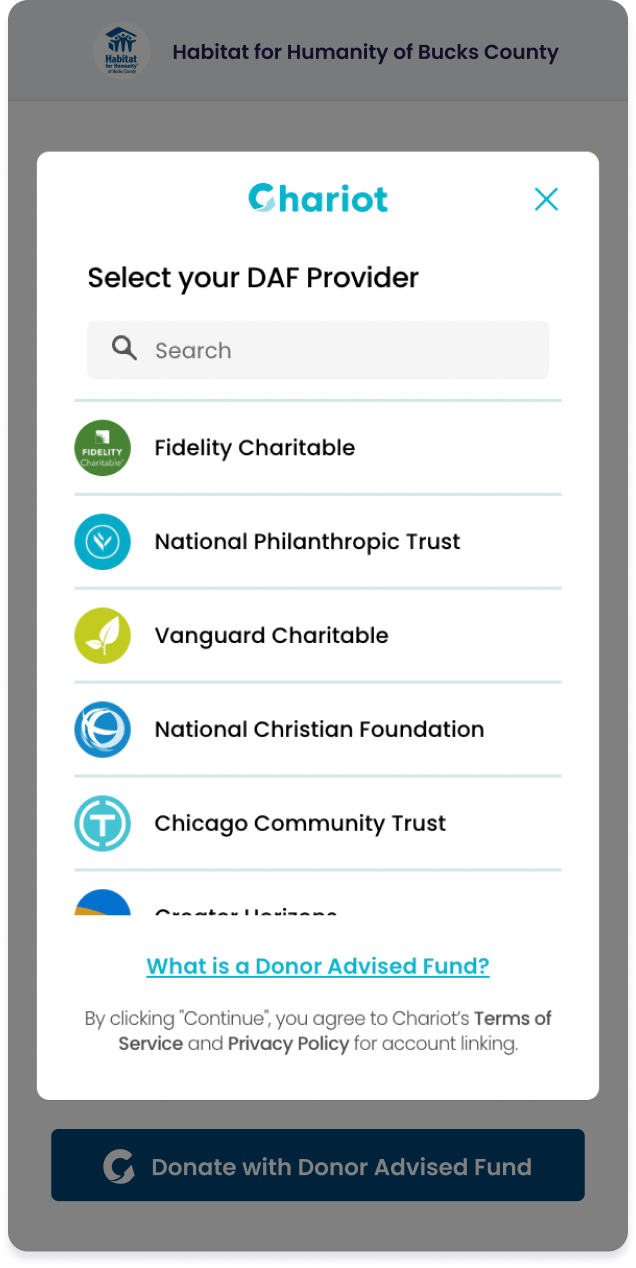

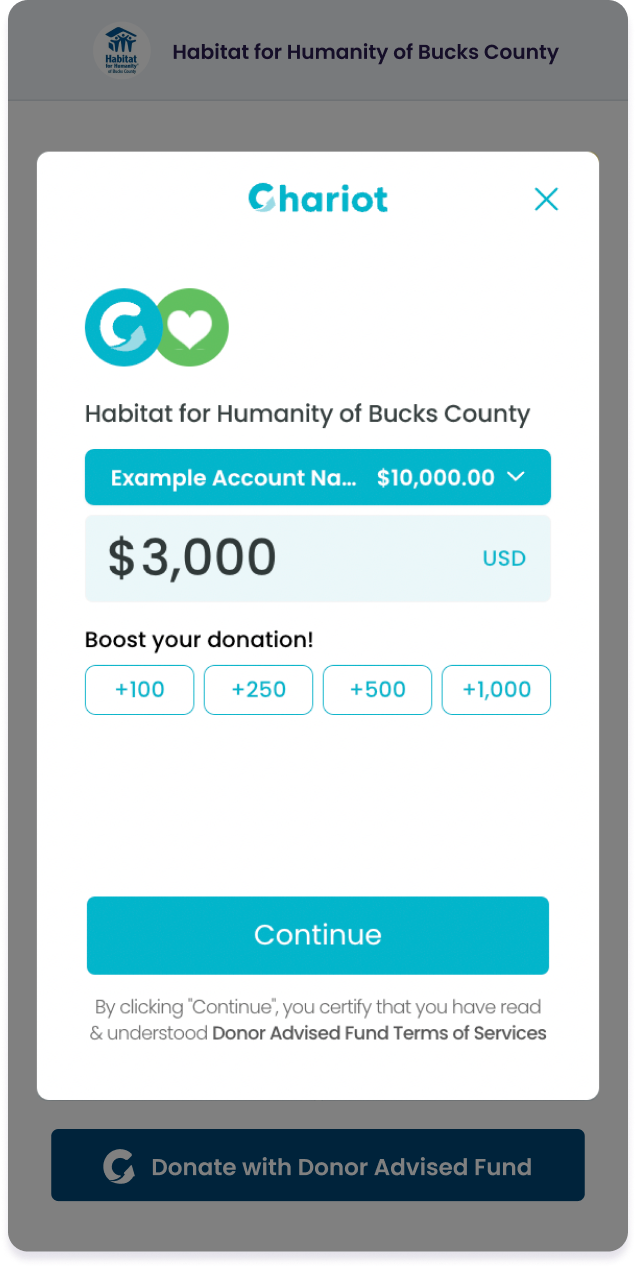

(The Giving Block and Chariot have streamlined the DAF donation process. Learn more about how we enabled DAF donations via a simple online form.)

Donor-Advised Funds: Pros and Cons

For high-net worth individuals, Donor-Advised Funds might be a smart way to maximize the charitable impact of various assets in their portfolios.

However, there may be some downsides. From the perspective of a donor, the fees and extra work required to manage a Donor-Advised Fund may not be worth the effort. Because funds can be left indefinitely in a DAF, some fundraising experts believe that Donor-Advised Funds, on the whole, negatively impact charities by delaying the act of donating.

DAF Benefits for Donors

Maximizing tax benefits: Donors can make immediate tax deductions when contributing to a DAF and can grow contributions over time tax-free. (Read more about the DAF tax benefits.)

Flexible funding options: Donors decide when, what, and where to give, as DAFs typically require no annual distributions and offer options for anonymous granting.

Wide range of assets supported: Donors can contribute cash, stocks, crypto and more.

Charitable legacy: DAFs are a relatively easy way to establish a fund that can be passed down to future generations that can carry on a family’s philanthropic legacy.

DAF Benefits for Nonprofits

Tap into new major donors: With a DAF fundraising strategy, nonprofits can tap into this $234B DAF market.

Larger gifts: Due to the potential tax benefits, DAFs provide an opportunity for nonprofits to receive higher donations. (The average grant size from a DAF is roughly $4,000.)

No fees for nonprofits: Grants from a DAF don’t include admin fees or operational overhead costs that often come with private foundation grants.

Potential Downsides of DAFs

Limited transparency: Nonprofits do not always have the ability to see the donor’s information when receiving a DAF grant.

Donated funds are irrevocable: Donors are not able to get assets back for personal use once deposited into a DAF.

Donor fees and minimums: Depending on the sponsoring organization, a donor may be responsible for annual fees or maintaining a certain minimum balance in their DAF.

While these are some pros and cons, keep in mind that philanthropy is a complex subject. Donors may have specific reasons for creating and contributing to a Donor-Advised Fund instead of donating directly to a charitable organization.

The Tax Benefits of a Donor-Advised Fund

Much of the hype around Donor-Advised Funds has to do with the numerous tax advantages associated with them, specifically the ability for donors to reduce their tax liability.

Is There a Donor-Advised Fund Tax Deduction?

Individuals with Donor-Advised Funds can claim a federal income tax deduction of up to 60% of their adjusted gross income (AGI) for cash contributions.

For contributions of non-cash assets like stock and cryptocurrencies, the tax deduction limit is set at 30% of AGI. Furthermore, donors contributing non-cash assets do not realize capital gains on appreciated assets contributed and therefore don’t have to pay capital gains tax on them.

Note that donors are only eligible for the tax benefits when funds are donated to a DAF. When grants are made from a DAF to a charity, the donor cannot claim these tax deductions again.

If Assets Grow in a DAF, Are Those Taxed?

No, assets in DAFs that appreciate in value will not be subject to further taxes.

In Comparison: Donor-Advised Funds vs. Other Giving Vehicles and Entities

While Donor-Advised Funds are unique, it’s easy to confuse them with other giving vehicles. Here are some key differences between similar ways to give:

Donor-Advised Fund vs. Private Foundation

A Donor-Advised Fund shares the 501(c)3 status of the sponsoring organization, while a private foundation must apply for its own 501(c)3 status. Furthermore, a trust or corporation is required to set up a private foundation. DAFs are relatively inexpensive to open and operate, whereas private foundations must file annual tax returns and meet minimum payout requirements.

Donor-Advised Fund vs. Charitable Trust

A charitable trust can provide donors with an income stream, whereas a DAF cannot. Because there are considerable expenses during setup, charitable trusts may also be better suited to ultra high net worth individuals. Donor-Advised Funds, on the other hand, have low or no set up costs but typically require a percentage of assets to be paid as fees to the DAF provider.

Donor-Advised Fund vs. 501(c)3 Organization

While a Donor-Advised Fund shares its 501(c)3 status with its sponsoring organization, it is not technically a 501(c)3 organization itself.

Donor-Advised Funds: Top Trends and Stats (2024)

Donor-Advised Funds are continuing to experience rapid growth and have solidified their position as a major force in philanthropy. Yet, many fundraisers still lag in effectively targeting and engaging DAF donors. Below are key statistics that showcase the growth and impact of DAFs and the ongoing challenges faced by nonprofits:

- In 2023, $52.2 billion was granted from DAFs, representing approximately 10.3% of all charitable giving.

- The value of DAF grants has increased 6x over the past decade, a clear indication of the growing importance of DAFs in the charitable sector.

- There are 1.95 million DAF accounts as of 2023, up significantly from 1.28 million in 2021.

- 79% of DAF assets are donated within 5 years of deposit, showcasing the strong propensity of DAFs to distribute funds efficiently.

- DAF donors show higher retention rates than non-DAF donors, with 60% of DAF donors retained year-over-year, compared to only 45% for non-DAF donors.

- 42% of fundraisers reported that their biggest challenge with DAFs is effectively integrating DAFs into their regular fundraising asks.

Sources: Chariot, Nonprofit Trust, Fidelity Charitable

All in all, most nonprofits cannot afford to miss out the fundraising opportunities presented by Donor-Advised Funds. That’s why it’s critical to understand how to navigate conversations about DAFs when the topic inevitably arises.

Boosting Your Nonprofit’s Revenue with DAF Donations

While Donor-Advised Funds may seem a bit divorced from the world of traditional fundraising, that’s not the case at all. As Donor-Advised Funds become a more popular option, it’s increasingly likely that some of your current or future supporters will want to use a DAF as a primary or secondary giving vehicle.

To effectively steward DAF grants, don’t be shy about offering DAF grants as a way for your donors to give to your cause.

Switch from Passive to Active DAF Fundraising

Most nonprofits have a section of their donation page that says “Contact us to discuss Donor-Advised Funds.” But for today’s high net worth donors, who are starting to trend younger on average, you’ll need a more digital-friendly option.Here are several ways you can increase your visibility and make the giving process as simple as 1-2-3:

- Include references to Donor-Advised Funds in your direct mail or other fundraising materials

- Add a section about Donor-Advised Funds to “ways to give” webpage

- Keep a record of DAF gifts you receive so that you can thank and reengage these donors later

- Keep your organization’s information up to date on GuideStar and Charity Navigator

- Enable easy Donor-Advised Fund donations via an online DAF donation form

Steward DAF Grants in Donor Conversations

On top of the best practices listed above, you can go the extra mile to secure Donor-Advised Fund donations from supporters. Try these talking points the next time one of your donors mentions making a grant from their DAF:

- Suggest that they use a grant to memorialize a loved one or commemorate a milestone

- Remind them of the tax benefits of Donor-Advised Funds

- Propose that they form a giving circle with other DAF owners to make grants

- Discuss DAFs in your planned giving conversations with major donors

- Ask donors if your organization can be named a beneficiary of their DAFs

By educating your fundraising team on the benefits of DAFs, you’ll be one step closer to securing a slice of that $234 billion dollar opportunity to further your mission.

Get Started with DAF Fundraising

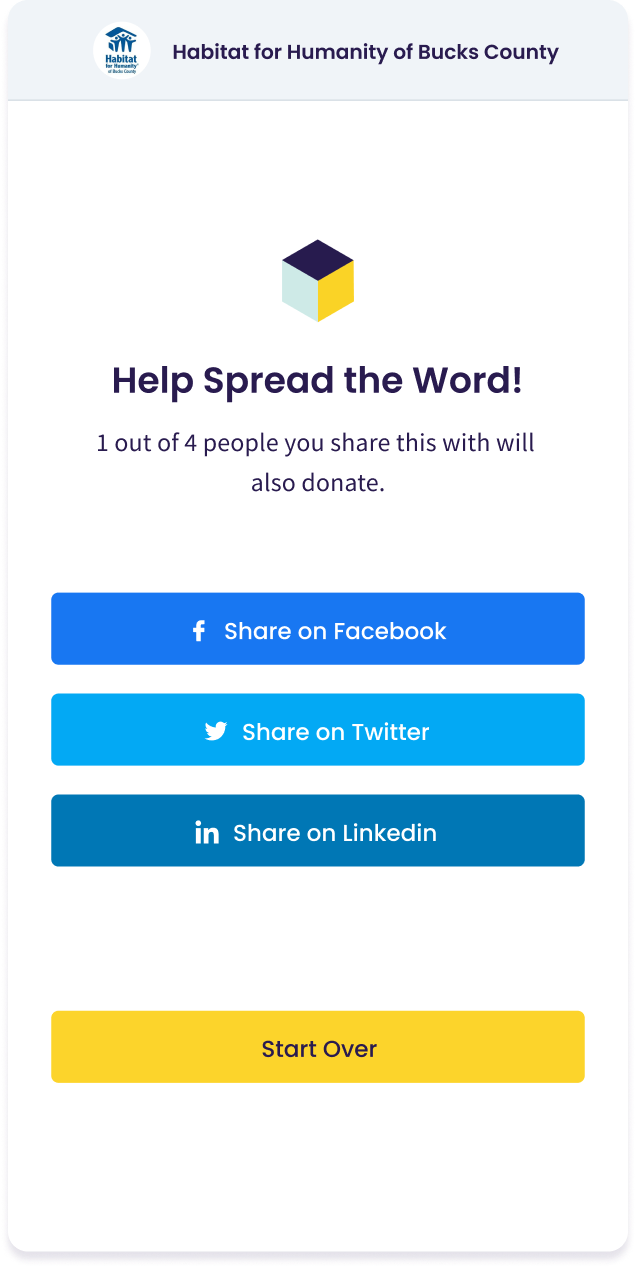

These days, fundraising and technology go hand-in-hand. As your nonprofit modernizes its fundraising systems and solutions to meet donor needs, it’s a no-brainer to include a streamlined DAF donation form.

That’s why The Giving Block and Chariot teamed up to make DAF donations easy to give and accept. We take care of the technical processes so that you can focus on your #1 priority: stewarding donations for your cause.

Our DAF fundraising solution provides the following awesome benefits:

- Accept DAF donations directly from your website

- Show donors their DAF balance and give them the option to boost their donation

- Collect and track DAF donation information

- Save donors time with direct DAF provider integrations

Ready to learn more? Schedule a conversation with our team to see why our all-in-one DAF and non-cash fundraising donation platform is a must-have in today’s fundraising landscape.