If you have ever donated crypto or your charitable organization accepts cryptocurrency donations, there’s a good chance you will encounter IRS Form 8283 at some point.

We’re here to help explain what you need to know about Form 8283, and which data points you’ll need to file one.

Want to make your donations easier to report on tax filings? If you make a cryptocurrency donation of over $5,000 to a charity using The Giving Block, we automatically generate a copy of Form 8283 and send it to the email address you share with us.

Read on to find out more about Form 8283 and how The Giving Block makes donating crypto a breeze.

What is Form 8283?

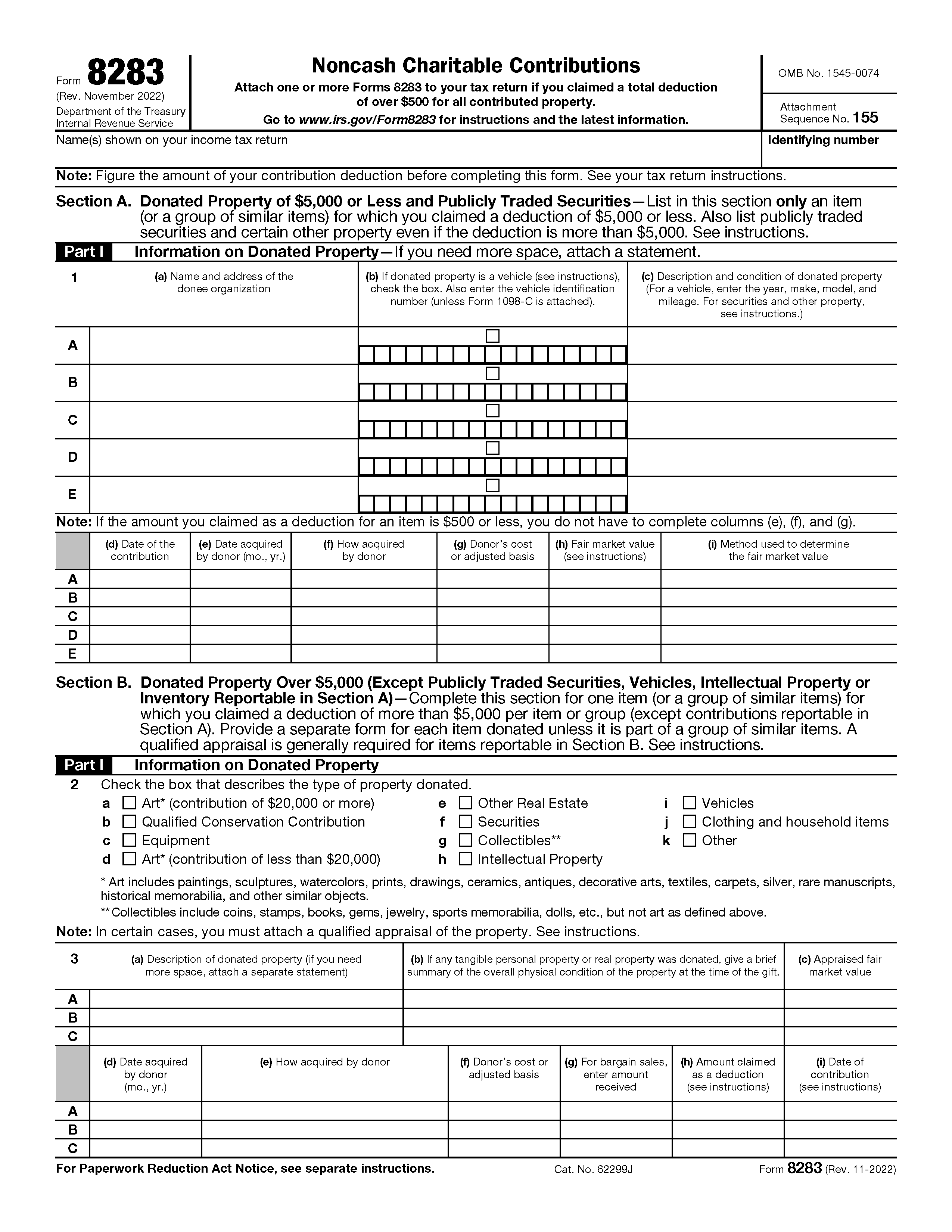

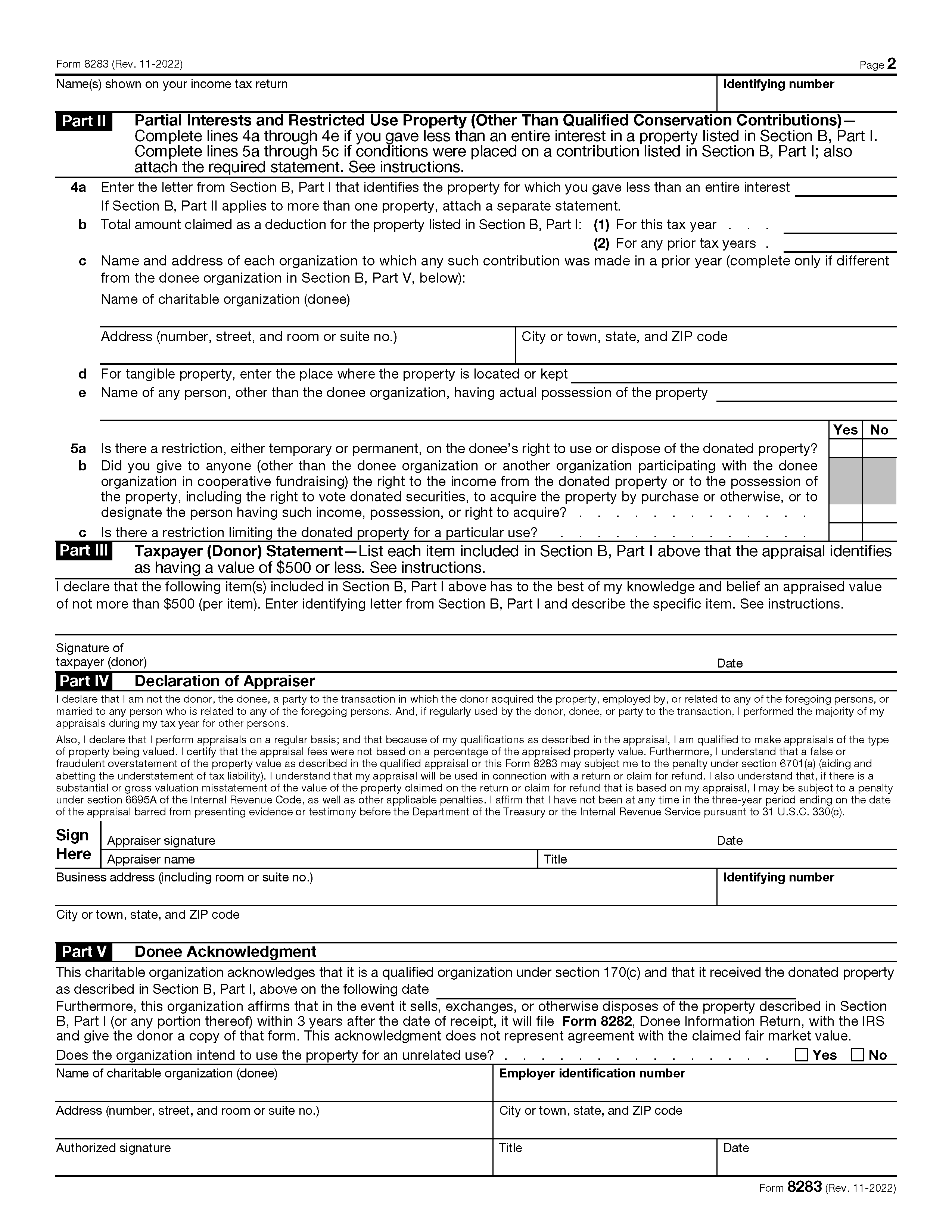

In brief, IRS Form 8283 helps to ensure that taxpayers accurately report the value of their noncash charitable contributions, and that they have donated these assets to eligible charities.

According to the IRS, Form 8283 is filed by individuals, partnerships, and corporations.

You can download a copy of Form 8283 on the IRS website.

What Counts as a Noncash Charitable Contribution?

Noncash contributions are charitable donations made in some form of property, including art, cryptocurrency, real estate, stocks or vehicles.

When is Form 8283 Due?

A copy of Form 8283 should be included with your tax returns. In the US, the tax filing deadline for calendar deadline filers typically falls in mid-April. To ensure you have the most up to date information, refer to the IRS article on “When to File.”

Form 8282 vs. Form 8283: What’s the Difference?

While Form 8283 is for donors to complete, Form 8282 is the responsibility of the “donee organization” (i.e. the charity receiving the donation).

The Giving Block also helps nonprofits complete Form 8282 for accurate reporting of cryptocurrency donations.

Instructions for How to File Form 8283

If you donated cryptocurrency to a registered charitable organization, you may be required to file a Form 8283. As a best practice, it’s smart to keep track of all your cryptocurrency donations for tax reporting purposes.

If you need to file Form 8283, at minimum you will need the following information:

- Your name and tax ID number

- The name and address of the donee organization

- The type of noncash contribution donated

- The fair market value of your donation

Note that Section V is for acknowledgment of the contribution by the donee organization. If you are a donor filing Form 8283, you will need to send a copy of the form to the donee organization and ask them to complete Section V and return it to you before filing.

For complete instructions on how to file Form 8283, refer to the IRS instructions.

Your Donation Size Determines Reporting Requirements

According to the IRS, reporting requirements vary for individuals depending on the value of their noncash charitable contributions:

- Individuals who make noncash charitable contributions below $500 are not required to complete Form 8283.

- For noncash donations valued between above $500 but less than $5000, donors must complete Form 8283.

- For noncash donations valued above $5,000, donors must complete Form 8283 and receive a qualified appraisal.

Need a tax advisor or qualified appraiser for crypto donations? Explore our crypto tax resources.

The Giving Block Makes Form 8283 Easier for Donors

Crypto donors can reduce Form 8283 reporting headaches by donating cryptocurrency on The Giving Block or to a charity that uses The Giving Block to process crypto donations.

When using The Giving Block, this means entering your name and a working email address so that you can receive a tax acknowledgement.

Entering this information can also be helpful as it can be used in a Form 8283 form that is automatically generated by The Giving Block and emailed to you.

Make Your Crypto Fundraising Strategy Seamless

Accepting crypto donations has helped thousands of nonprofits diversify their fundraising revenue and reach new donors. Choosing a crypto fundraising solution is a vital decision.

The Giving Block is the leading solution for nonprofits fundraising cryptocurrency. Our platform offers:

- Automatic Form 8282/8283 generation for donations

- Auto-selling of crypto donations for cash upon receipt

- 5000+ integrations with popular CRMs and workflows

- Donation dashboard to track the gifts you receive

- Hands-on support from crypto fundraising experts

The Giving Block team made set-up super easy and assured a smooth donor experience from crypto gift to receipting, and our Finance team especially appreciates the platform’s autosell conversion to cash.

To learn more about how our platform and support helps nonprofits get started and succeed in crypto fundraising, reach out to our team today.

Disclaimer: This article was written for general informational purposes only, and is not financial advice. Please consult with a qualified tax advisor regarding your specific needs and responsibilities.